Financial advice and wellbeing: a match made in heaven

Recent research has found that those who receive professional financial advice are four times more likely to enjoy high levels of financial wellbeing1. In addition, clients who take advice build up three times more pension wealth on average (£246,000) than those who don’t (£95,000). Advised clients also accumulated more than double the non-pension savings (£65,000) of those who didn’t see an adviser (£32,000).

1Aegon, 2021

The value of investments and income from them may go down. You may not get back the original amount invested. A pension is a long-term investment. The fund value may fluctuate and can go down. Your eventual income may depend on the size of the fund at retirement, future interest rates and tax legislation.

Annex army on the march

The words ‘Granny’ and ‘annex’ may go together like salt and pepper but converting existing outbuildings into residential space is no longer the preserve of those needing to home elderly parents.

Lockdown syndrome

The events of the past 18 months may have given annexes a new lease of life. Councils received approximately 9,000 planning applications for annexes in 2019-201, perhaps unsurprising given that lockdown has made extra space increasingly desirable. Confined to our homes and trying to work from the dining room table or sofa, the thought of a home office has appealed to many.

A desire for extra space may be a major motivation to convert an old shed, but it isn’t the only reason to add an annex to your home. Research suggests an annex adds an average of £91,000 to the value of a property and generates greater interest among buyers.

To host or not to host

If you are thinking of joining the annex army, you first need to be clear what your conversion is for. A home office is relatively simple, requiring a single room and perhaps toilet facilities. On the other hand, if your ambition is to host airbnb guests, you’ll probably need several rooms, including a full bathroom, kitchen facilities, living space and bedroom.

Plan your planning

It’s important to consider planning permission too. If you’re converting an existing outbuilding, like a garage or shed, you might not need it. However, you probably will need to submit a planning application for larger projects.

Even if you don’t build anything, acquiring planning consent before you sell can boost your property’s value because prospective buyers will know they have the option to build their own annex should they wish.

1Churchill Home Insurance, 2021

As a mortgage is secured against your home or property, it could be repossessed if you do not keep up mortgage repayments.

Economic Review – November 2021

Inflationary pressures mount

Official statistics show the UK headline rate of inflation now stands at a 10-year high, with surveys pointing to further upward pressure as firms continue to report rapidly-rising cost burdens.

Data released last month by the Office for National Statistics (ONS) revealed that the Consumer Prices Index (CPI) 12-month rate – which compares prices in the current month with the same period a year earlier – rose to 4.2% in October. This was above all predictions in a Reuters poll of economists and represents a considerable jump from September’s rate of 3.1%.

The rise was largely driven by higher household energy bills following the lifting of the regulatory price cap on 1 October, with gas prices paid by consumers up 28.1% and electricity up 18.8% in the year to October. ONS said price rises were evident across the board with the cost of petrol, second-hand cars, furniture and household goods, hotel stays and eating out all increasing noticeably.

Some of the current increase in the rate of inflation is inevitably due to weak price levels witnessed in October last year when the pandemic was dragging down economic activity. Analysts do expect to see inflation ease somewhat next year as these factors begin to drop out of the data.

Survey evidence, though, suggests there are further inflationary pressures in the pipeline. Preliminary data from November’s IHS Markit/CIPS Composite Purchasing Managers’ Index, for instance, revealed record cost pressures, with input price inflation ‘rising at the fastest rate since the index began in 1998’, fuelled by ‘higher wages and a spike in prices paid for fuel, energy and raw materials.’

November’s Monthly Industrial Trends Survey published by the Confederation of British Industry (CBI) also highlighted the current inflationary pressures; output price expectations among manufacturers climbed to the highest level since May 1977.

Rate rise speculation intensifies

The Chief Economist at the Bank of England (BoE) has given a clear hint that interest rates are set to rise soon, although the emergence of the Omicron variant has cast some doubt over the exact timing.

At a meeting ending on 4 November, the BoE’s Monetary Policy Committee (MPC) voted to leave the Bank Rate unchanged at its historic low level of 0.1%. Policymakers, however, were split on the decision, with two of the nine-member committee voting for an immediate hike to 0.25%.

Bank Governor Andrew Bailey described the decision as a “very close call.” Mr Bailey went on to say that the MPC had “spent many hours” pondering its decision and did not rule out a rate increase when the committee next convenes in mid-December. The Governor was, though, at pains to stress that rates were unlikely to rise sharply, adding “for the foreseeable future, we’re in a world of low interest rates.”

Since the last meeting, a number of policymakers have indicated a growing willingness to act in order to counter above-target inflation, with the clearest hint to date coming from BoE Chief Economist Huw Pill. Speaking at a CBI conference on 26 November, Mr Pill suggested the conditions now existed for him to vote for higher rates and indicated that he was minded to do so soon.

Mr Pill said, “The ground has now been prepared for policy action. Given where we stand in terms of data and analysis, I view the likely direction of travel for monetary policy from here as pretty clear.” The Chief Economist, however, also noted that the Omicron strain could throw a potential spanner in the works and stressed there was no guarantee the MPC would sanction a rate hike when its next meeting concludes on 16 December.

Markets (Data compiled by TOMD)

Discovery of the Omicron variant impacted markets as investors considered the risk to the global economic recovery. After initial market falls, stocks largely regained their composure on Monday 29 November, as indices recovered some of the losses seen during the previous trading session.

On the last day of the month however, concerns intensified over the efficacy of current vaccines against the new strain; markets felt the impact of this uncertainty. In the UK, buoyed by miners, the FTSE 100 managed to pull back from steep losses, when it pushed below the 7,000-point mark for the first time in nearly two months. The index closed the month down 2.46%, to end November on 7,059.45. The mid cap FTSE 250 index closed on 22,519.72, a monthly loss of 2.54% and the Junior AIM index closed on 1,187.56, a loss of 2.91% in the month. The Euro Stoxx 50 fell 4.41% in the month to close on 4,063.06. In Japan, the Nikkei 225 recorded a loss of 3.71% in the month, to close on 27,821.76.

US stocks fell at month end after Federal Reserve Chairman Jerome Powell remarked that inflation can no longer be considered transitory. He also signalled an earlier-than-expected end to monthly bond purchases, potentially opening the door to interest rate increases. The Dow closed the month down 3.73%, the NASDAQ gained 0.25%.

Concerns that the new variant could slow global economic growth sent oil prices lower. The Organisation of the Petroleum Exporting Countries and its allies (OPEC+) postponed technical meetings to early December, giving themselves more time to assess the impact of the variant on oil demand and prices. Brent Crude is currently trading at around $68 per barrel, a loss of over 18% on the month. Gold is currently trading at around $1,798 a troy ounce, a small gain of around 1.6% over the month.

On the foreign exchanges, sterling closed the month at $1.32 against the US dollar. The euro closed at €1.17 against sterling and at $1.13 against the US dollar.

| Index | Value (30/11/21) | Arrow up or down | Movement since 29/10/21 |

| FTSE 100 | 7,059.45 | down | 2.46% |

| FTSE 250 | 22,519.72 | down | 2.54% |

| FTSE AIM | 1,187.56 | down | 2.91% |

| Euro Stoxx 50 | 4,063.06 | down | 4.41% |

| NASDAQ Composite | 15,537.69 | up | 0.25% |

| Dow Jones | 34,483.72 | down | 3.73% |

| Nikkei 225 | 27,821.76 | down | 3.71% |

Jobs market withstands furlough end

The latest set of employment statistics suggests the demise of furlough has done little to dent the strong labour market recovery that has been evident over recent months.

Figures published last month by ONS showed demand for staff remains high, with the number of job vacancies rising to another record level. In total, there were just under 1.2 million vacancies advertised in the three months to October, nearly 400,000 more than before the onset of the pandemic.

The data also revealed there were 160,000 more workers on company payrolls in October than September; this latest rise means the overall number of employees is now significantly higher than pre-pandemic levels. Interestingly, the redundancy rate was reported as largely unchanged despite withdrawal of the government’s furlough scheme on 30 September.

Commenting on the figures, ONS Head of Economic Statistics Sam Beckett said, “It might take a few months to see the full impact of furlough coming to an end. However, October’s early estimate shows the number of people on the payroll rose strongly on the month and stands well above its pre-pandemic level. And businesses tell us that only a very small proportion of their previously furloughed staff have been laid off.”

Retailers enjoy early Christmas lift

An early Christmas spending spree provided retailers with a significant boost in October, while survey evidence suggests sales growth looks set to continue into the festive period.

According to the latest ONS data, retail sales volumes rose by 0.8% in October to end a run of five successive months with no growth at all. The increase, which beat analysts’ expectations, was focused on the non-food store sector, including clothing and toy sales. ONS noted that some retailers felt “early Christmas trading had boosted sales.”

The latest Distributive Trades Survey from the CBI suggests this trend continued last month with the net balance of retailers reporting sales growth rising from +30 in October to +39 in November; this represents the strongest pre-Christmas reading since 2015. Furthermore, retailers said they expect sales to remain above seasonal norms in December as well.

CBI Principal Economist Ben Jones commented, “Christmas seems to have come early for retailers, with clothing and department stores in particular seeing a big upward swing in sales volumes. It seems likely that reports of supply chain disruptions prompted consumers to start their Christmas shopping early. Overall, retailers are becoming more optimistic.”

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.

News in Review

‘The global recovery is strong but imbalanced’

Last week saw the Organisation for Economic Co-operation and Development (OECD) publish its latest appraisal of world economic prospects. In a relatively upbeat assessment, the Paris-based soothsayer predicted that global growth will hit 5.6% this year before moderating to 4.5% in 2022 and 3.2% in 2023. However, the OECD did warn of potential risks suggesting the global recovery is strong but imbalanced.’

Perhaps unsurprisingly, a key area of concern relates to the Omicron COVID variant which OECD Chief Economist Laurence Boone said could pose “a threat to the recovery, delaying a return to normality or something even worse.” However, while the forecasting agency did warn that the new variant threatens to intensify the imbalances that are slowing growth and raising inflationary pressures, it also advised monetary policymakers to be ‘cautious,’ stating that the most pressing policy requirement was currently to accelerate the vaccine roll-out programme globally.

UK growth forecasts

In terms of the UK economy, the OECD increased its 2021 growth forecast to 6.9%, 0.2 percentage points higher than previously expected. This upgrade propelled the UK to the top of this year’s G7 growth rankings, although looking further ahead the OECD did warn that ‘a prolonged period of acute supply and labour shortages could slow down the recovery.’

Similar themes also featured in Monday’s updated forecasts released by the Confederation of British Industry (CBI) and accounting firm KPMG. The CBI said it now expects growth of 6.9% this year and 5.1% in 2022, downgrades from previous predictions of 8.2% and 6.1%, which largely reflect weaker-than-anticipated data released since its June forecast. KPMG issued a more pessimistic prediction; its ‘best-case’ scenario forecasts a growth rate of 4.2% next year, with any additional disruption due to the Omicron strain expected to dampen the recovery further.

Rate rise in the balance

The economic impact of the new virus strain is also inevitably featuring in Bank of England (BoE) policymakers’ deliberations. In a speech on Friday, Michael Saunders, one of two Monetary Policy Committee (MPC) members to vote in favour of a rate hike last month, cast doubts on whether he will take a similar stance at next week’s meeting. Mr Saunders said, “At present, given the new Omicron COVID variant has only been detected quite recently, there could be particular advantages in waiting to see more evidence on its possible effects on public health outcomes and hence on the economy.”

On Monday, however, comments made by another MPC member highlighted the dilemma currently facing the Bank’s policymakers. BoE Deputy Governor Ben Broadbent said inflation could “comfortably exceed 5% when the Ofgem cap on retail energy prices is next adjusted in April” and suggested the tight labour market risked becoming a more persistent source of inflation. Following both sets of comments, analysts suggested a December rate rise very much hangs in the balance.

No sign of labour squeeze easing

Data released last Friday found the shortage of workers that is hampering UK businesses shows no signs of abating. According to figures from the Recruitment & Employment Confederation (REC), the number of job adverts continued to grow rapidly last month, with a further 210,000 new adverts posted during the week of 22-28 November. This took the total number of active job postings to over 3.5 million, a 16% increase since the end of October. REC Chief Executive Neil Carberry commented, “The growth in job adverts shows no signs of slowing as we reach the Christmas peak. Firms need to think about how they will attract staff facing greater competition than ever before.”

House prices continue to rise

Two house price indices were released in the last seven days, with both showing a continuation of the recent surge in prices. The Halifax index posted a fifth consecutive monthly rise, with prices in November 8.2% above year-earlier levels, which the mortgage lender said reflected a shortage of available properties, strong jobs market and low borrowing costs. Nationwide reported annual house price growth of 10% in November, although the building society described the outlook as ‘uncertain’, with concerns expressed over the impact of the Omicron variant on the wider economy.

Here to help

Financial advice is key, so please do not hesitate to get in contact with any questions or concerns you may have.

The value of investments can go down as well as up and you may not get back the full amount you invested. The past is not a guide to future performance and past performance may not necessarily be repeated.

Becoming a financial wellbeing ‘all-rounder’

Financial wellbeing is closely aligned with the control people have over their financial future. People with high levels tend to meet their long-term financial goals and have a clear idea about what makes them happy and what they want from life. This allows them to identify and achieve more meaningful life goals before and during retirement.

Balancing mind and money

People with a financial adviser are over four times more likely to display high levels of financial wellbeing, a new study1 has determined.

Based on a survey of 10,466 UK residents, the study highlighted that the key to building financial wellbeing is to have both ‘mindset’ and ‘money’ building blocks. Those with the best financial wellbeing scores did well on both fronts.

Are you an ‘all-rounder’?

Respondents with the best possible combination of scores were classified as ‘all-rounders’, with this group financially comfortable and enjoying life now while also planning for their future happiness. Such people are equipped to achieve the perfect balance between understanding the importance of both money and mindset.

Wellbeing and advice aligned

Unsurprisingly, the data highlighted that people who seek professional financial advice are far more likely to fit into the ‘all-rounder’ category, when compared with those who do not. Only 10% of those who had never received financial advice were lucky enough to combine a positive money mindset with healthy finances, compared to 44% of those who have an ongoing relationship with their adviser.

1Aegon, 2021

The value of investments and income from them may go down. You may not get back the original amount invested.

A lifetime of investing

As we move through life, our plans and goals will inevitably change. This also goes for our investment strategies, which need to flex and adapt as we move through the decades.

Your twenties and thirties

The financial decisions we make in early adulthood set the foundations for the rest of our lives. At this stage, one of your key goals should be to start saving. Retirement may seem a long way away but getting into good financial habits now could mean the difference between a comfortable retirement and having to work well into your later years.

Due to the timescales involved, now is the time to take on a little more risk – you’re more likely to recover any losses in the long term. So, it makes sense to put most of your savings into equity investments, which offer the highest potential for growth. Remember, you’ll also need some easily accessible savings for unexpected expenses, or to put down a property deposit.

Turning 40 and 50

Often considered the peak earning years, your forties and fifties should be dedicated to bolstering your pension and investment portfolio. It is also vital to have a sound, tax-efficient financial plan in place at this stage, with regular reviews to ensure you remain on track to meet your goals. As you approach retirement, a more conservative approach may be appropriate, with funds switching from equities to more stable asset categories.

Steady on in your sixties

With the State Pension Age continuing to rise, many people are now working and investing until well into their sixties. Your attention will now be shifting to income-generating products, and ensuring your income remains in line with your living expenses. You’ll also likely be considering the best and most tax-efficient ways to protect and transfer your wealth.

The value of investments and income from them may go down. You may not get back the original amount invested. A pension is a long-term investment. The fund value may fluctuate and can go down. Your eventual income may depend on the size of the fund at retirement, future interest rates and tax legislation.

News in Review

“We need to bolster our protections against this new variant”

Following the discovery of the COVID-19 Omicron variant on UK shores, Boris Johnson took to the Downing Street podium on Saturday to announce “temporary and precautionary” measures to contain the spread of the variant.

First detected in South Africa last Wednesday and labelled a ‘variant of concern’ by the World Health Organization, early evidence suggests Omicron has a higher reinfection risk. The Prime Minister commented, “Our scientists are learning more hour by hour, and it does appear that Omicron spreads very rapidly and can be spread between people who are double vaccinated.” He added, “We need to bolster our protections against this new variant… measures at the border can only ever minimise and delay the arrival of a new variant rather than stop it all together.”

Added to the ‘Red List’ last Thursday, South Africa, Botswana, Namibia, Zimbabwe, Lesotho and Eswatini have since been joined by Angola, Zambia, Malawi and Mozambique. In addition, PCR tests have been introduced for everyone entering the UK (test by the end of the second day following arrival and self-isolate until a negative result) and all contacts of new variant cases must self-isolate for ten days, even if fully vaccinated. From Tuesday, face coverings became mandatory again in shops, on public transport and other inside settings in England; and the booster programme will be rapidly extended, including offering boosters to all over 18s in the UK and reducing the gap between second doses and boosters. During a briefing on Tuesday, Boris Johnson confirmed that all adults will be offered a booster jab by the end of January. As with other stages of the vaccine rollout, people will be worked through by age group.

The new measures are due to be reviewed in three weeks, by which time better information will be available on the effectiveness of vaccines.

Markets react

Global stock markets faltered last week, as concerns intensified over the impact of the variant on global economic growth, with shares in airlines and travel firms hit particularly hard. Oil prices were also sharply lower but regained some ground. The Organisation of the Petroleum Exporting Countries and its allies (OPEC+) postponed technical meetings to later this week, giving themselves more time to assess the impact of the variant on oil demand and prices. Stock markets regained some ground this week but remain tentative, as investors closely assess the threat of the variant.

Bumper Black Friday spending to beat last two years

Consumer spending on Black Friday (26 November) is expected to surpass sales figures from the past two years, according to analysts. Barclaycard, which processes around a third of all card transactions, said that spending was up 23% on last year and 2.4% up on 2019 by 5pm GMT, while financial analysts PwC predicted that Friday’s total spend would be £8.7bn – double that spent during last year’s November lockdown.

Black Friday, originally a US event, may officially be just one day, but most retailers use extended periods to entice shoppers with heavy discounts in the run-up to Christmas. After last year’s disappointing turnout, it is very much hoped that Black Friday’s strong start will continue into the festive season.

The spending figures perhaps reflect a desire on the part of UK shoppers to get their Christmas shopping done early, with this year’s sales set against a backdrop of international shipping issues and a UK-wide HGV driver shortage.

UK car output sinks to 65-year low

A shortage of computer chips has been blamed for the lowest car production level in over six decades this October. Production fell by 41% month-on-month, a situation which Society of Motor Manufacturers and Traders (SMMT) Chief Executive Mike Hawes called “extremely worrying”. The semiconductor shortage, compounded by the closure of a Honda manufacturing plant in Swindon in 2020, has resulted in the fourth consecutive month of decline.

There are some positives, however. The production of electronic and hybrid vehicles continues apace ahead of the government’s ban on petrol and diesel cars by 2030, with production of battery electric cars rising by 17.5% to 8,454 cars in October. In total, UK car manufacturers have built over 50,000 zero-emission vehicles in 2021, according to SMMT figures.

Here to help

Financial advice is key, so please do not hesitate to get in contact with any questions or concerns you may have.

The value of investments can go down as well as up and you may not get back the full amount you invested. The past is not a guide to future performance and past performance may not necessarily be repeated.

Residential Property Review – November 2021

Spending pledges for housing in Autumn Budget

In his Autumn Budget delivered at the end of October, Chancellor Rishi Sunak committed more cash to building new homes on derelict or unused land in England, as part of a £24bn fund earmarked for housing.

The plans will see 160,000 greener homes built on brownfield land and the addition of up to 180,000 new affordable homes. £9m was also pledged for 100 ‘pocket parks’, which promise to be “safe and usable green spaces” in urban settings.

Delivering his Budget speech, the Chancellor said, “We’re investing more in housing and homeownership too, with a multi-year housing settlement totalling nearly £24bn: £11.5bn to build up to 180,000 new affordable homes. And we’re investing an extra £1.8bn, enough to bring 1,500 hectares of brownfield land into use, meet our commitment to invest £10bn in new housing and unlock a million new homes.“

First-time buyers at the fore

September saw transaction activity spike for a third time this year in the residential market, with house sales 63% above their 2017-19 monthly average. A dip in activity is expected to emerge in the October data, following the end of the Stamp Duty holiday.

Meanwhile, first-time buyers (FTBs), who had previously benefited less from the tax holiday, became the largest buyer type, although expected rises in mortgage rates may soon dampen some enthusiasm. Despite the Bank of England voting to hold Base Rate at 0.1% on 4 November, analysts expect inflationary pressures to force the Bank to act soon.

Rises in Base Rate would inevitably translate into higher mortgage costs. According to Savills, however, the immediate effect on the housing market is likely to be limited, given that any rise is expected to be relatively small and that most mortgages are on fixed rates.

High costs stop homes from going green

A recent survey by think tank Onward and J.L. Partners, has revealed that Brits want to see the housing sector modernised – but are not necessarily willing to put their money where their mouth is.

Currently, three in 10 homes in England and Wales built pre-war still carry an EPC rating of E or below and heating these inefficient properties is responsible for 70% of housing emissions. Modernising the housing sector would play a vital role in the UK’s efforts to reach net-zero emissions given that homes are responsible for a fifth of all UK greenhouse gas emissions.

However, the study found that less than half of respondents would be willing to pay higher taxes for the UK to hit its green targets. Even those who agreed in principle often balked at the price tag and home improvement policies saw their biggest decline in support after respondents were told the cost of making the changes.

The plans will see 160,000 greener homes built on brownfield land and the addition of up to 180,000 new affordable homes. £9m was also pledged for 100 ‘pocket parks’, which promise to be “safe and usable green spaces” in urban settings |

House Prices Headline statistics

| House Price Index (Sept 2021)* | 141.6* |

| Average House Price | £269,945 |

| Monthly Change | 2.50% |

| Annual Change | 11.80% |

*(Jan 2015 = 100)

- Average house prices in the UK increased by 11.8% in the year to September 2021

- On a non-seasonally adjusted basis, average house prices in the UK increased by 2.5% between August and September 2021

- House price growth was strongest in the North West where prices increased by 16.8% in the year to September 2021.

House Prices Price change by region

| Region | Monthly Change (%) | Annual Change (%) | Average Price (£) | |

|---|---|---|---|---|

| England | 2.9 | 11.5 | £287,895 | |

| Northern Ireland (Quarter 3 – 2021) |

3.0 | 10.7 | £159,109 | |

| Scotland | -0.4 | 12.3 | £180,334 | |

| Wales | 2.5 | 15.4 | £196,216 | |

| East Midlands | 4.9 | 14.7 | £231,318 | |

| East of England | 1.7 | 9.3 | £327,982 | |

| London | -2.9 | 2.8 | £507,253 | |

| North East | 3.8 | 13.3 | £152,776 | |

| North West | 5.3 | 16.8 | £203,661 | |

| South East | 3.0 | 11.7 | £370,886 | |

| South West | 4.0 | 11.7 | £301,327 | |

| West Midlands Region | 3.1 | 11.7 | £231,501 | |

| Yorkshire & The Humber | 4.0 | 11.9 | £192,354 |

Source: The Land Registry

Release date: 17/11/21 Next data release: 15/12/21

Average monthly price by property type – Sept 2021

| Property Type | Annual Increase |

|---|---|

| Detached £419,714 |

13.8% |

| Semi-detached £258,757 |

12.4% |

| Terraced £221,773 |

12.7% |

| Flat / maisonette £222,462 |

6.5% |

Source: The Land Registry

Release date: 17/11/21

Housing market outlook

“With the Bank of England expected to react to building inflation risks by raising rates as soon as next month, and further such rises predicted over the next 12 months, we do expect house buying demand to cool in the months ahead as borrowing costs increase. That said, borrowing costs will still be low by historical standards, and raising a deposit is likely to remain the primary obstacle for many.“ Russell Galley, Managing Director at Halifax |

Contains HM Land Registry data © Crown copyright and database right 2017. This data is licensed under the Open Government Licence v3.0.

All details are correct at the time of writing (18 November 2021)

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.

Commercial Property Market Review – November 2021

Business rates boost for hospitality and leisure

The Autumn Budget provided good news for badly hit shops, restaurants, bars and gyms, with a temporary 50% cut in business rates in England announced by the Chancellor.

These sectors, which suffered particularly badly during the pandemic, will be able to claim a 50% discount on their bills up to a maximum of £110,000, a tax cut worth almost £1.7bn. They weren’t the only ones to receive a financial boost though; a planned annual increase in rates for all firms was scrapped for the second consecutive year.

Mike Hughes, NAEA Propertymark Commercial Board Member, welcomed the Chancellor’s business rates announcement. He commented, “Most retail, hospitality, and leisure businesses are still fighting hard to get back on an even keel following the COVID-19 pandemic and so the certainty of continued business rates relief for these sectors is a great help. This will aid those business owners and investors looking to prepare their properties for sale and give purchasers the confidence to progress with acquisitions.“

ESG at the forefront post-COP26

A new study by Deepki has shown that more than half of the UK commercial property sector expects an increased focus on environment, social and governance (ESG) issues in the aftermath of COP26, while two thirds believe the World Green Building Council’s 2050 net-zero targets are achievable.

Many industry leaders acknowledge that the commercial property sector will play a vital role in addressing climate change, given that the built environment is currently responsible for about 40% of global carbon emissions. At COP26 in Glasgow, a panel event entitled ‘Commercial buildings: A real asset in addressing climate change?‘ discussed the obstacles and necessary action for meaningful progress and cross-sectoral action on environmental standards.

A primary challenge remains the investment needed to decarbonise commercial buildings. With almost half of respondents agreeing that retrofitting or addressing the carbon footprint of older buildings is a priority, analysts predict significant improvements could be made in the years ahead.

EPC B rating still elusive despite demand

According to Savills, more than a billion square feet of UK office stock has an EPC rating of C or below, which means 87% of buildings fall short of the proposed minimum B rating.

This target comes from a consultation held by the Department for Business, Energy and Industrial Strategy between March and June 2021, which set itself the goal of implementing a framework to ensure all non-domestic rented buildings achieve an EPC rating of at least B by 2030. The responses to the consultation are due to be published later this year.

Despite the abundance of unsustainable space, there is growing demand for buildings with high EPC standards. Indeed, Savills reports that demand for office space that can satisfy ESG credentials is currently outpacing supply.

Analysts suggest that tenants are attracted to sustainable office spaces by reputational benefits and lower energy bills, while growing demand could allow landlords who make their office stock comply with the new rules to benefit from higher occupancy rates.

| Many industry leaders acknowledge that the commercial property sector will play a vital role in addressing climate change |

Commercial property currently for sale in the UK

- Regions with the highest number of commercial properties for sale currently are South West England and London

- Northern Ireland currently has the lowest number of commercial properties for sale (23 properties)

- There are currently 1,427 commercial properties for sale in London, the average asking price is £1,594,264.

| Region | No. properties | AVG. asking price |

|---|---|---|

| London | 1,427 | £1,594,264 |

| South East England | 1,206 | £2,063,460 |

| East Midlands | 760 | £953,869 |

| East of England | 801 | £664,106 |

| North East England | 800 | £302,180 |

| North West England | 1,359 | £396,723 |

| South West England | 1,518 | £823,806 |

| West Midlands | 1,081 | £498,428 |

| Yorkshire and The Humber | 1,121 | £356,416 |

| Isle of Man | 52 | £477,082 |

| Scotland | 1,143 | £334,552 |

| Wales | 784 | £432,460 |

| Northern Ireland | 23 | £630,812 |

Source: Zoopla, data extracted 18 November 2021

Commercial property outlook

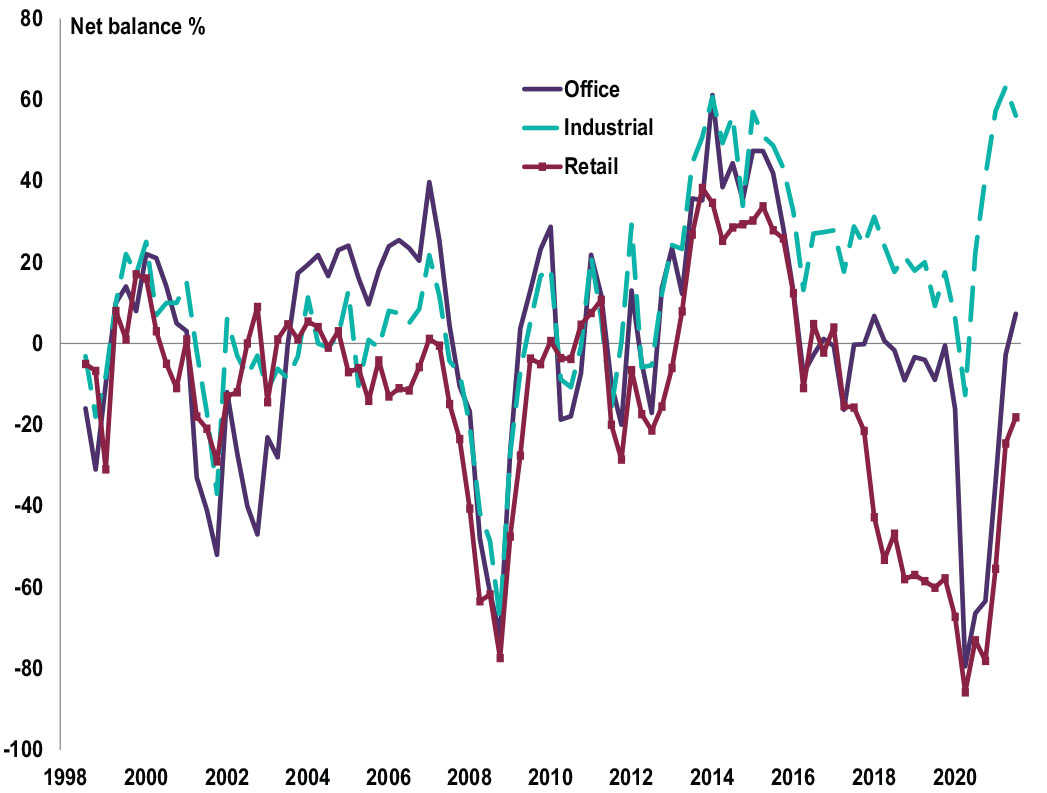

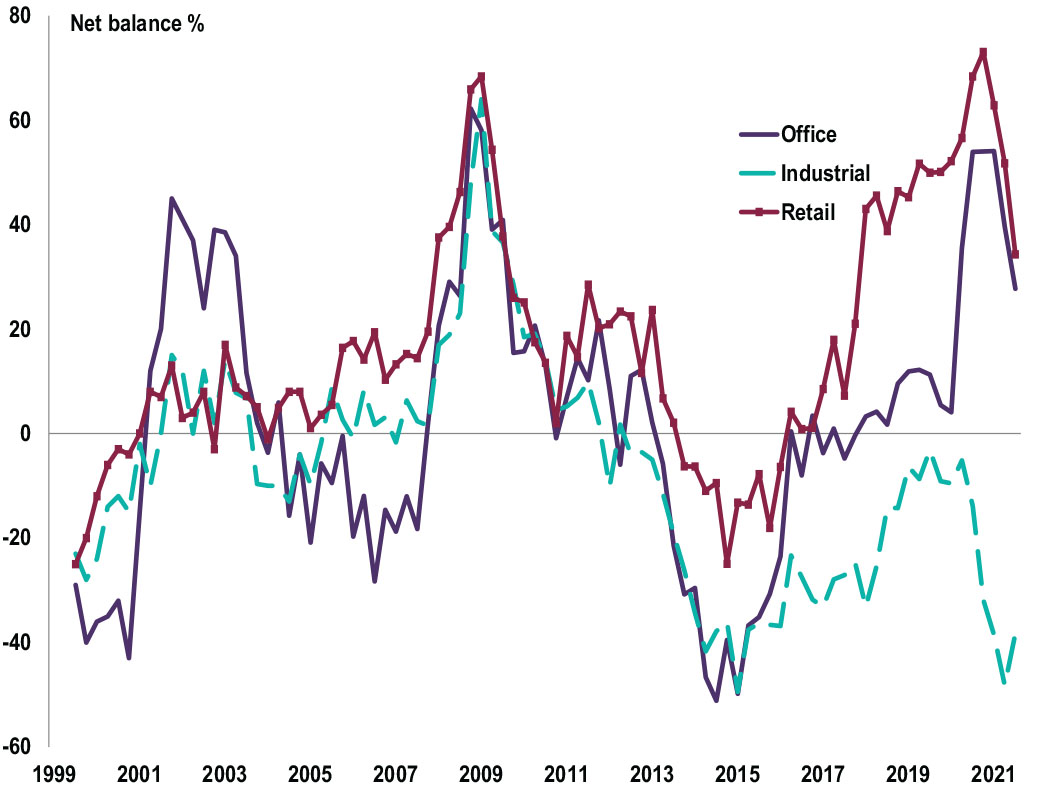

Occupier demand – broken down by sector

- A headline net balance of +18% of contributors reported a pick-up in overall tenant demand over Q3

- A net balance of +56% reported an increase in demand for industrial space

- Occupier demand for office space showed the first positive reading since early 2018 at +7%

- The retail sector remains subdued at -18%.

Source: RICS, UK Commercial Property Market Survey, Q3 2021

Availability – broken down by sector

- The supply of available industrial space remains negative, with the latest net balance standing at -38% in Q3

- Rising vacancies for office and retail continue to be seen, returning net balances of +28% and +34% respectively in Q3.

Source: RICS, UK Commercial Property Market Survey, Q3 2021

All details are correct at the time of writing (18 November 2021)

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.