“Although supply chains remain severely stretched, there are at least signs that the situation is stabilising”

As the new year takes root, the latest IHS Markit/CIPS Purchasing Managers’ Index has highlighted an elevated level of optimism amongst UK manufacturing firms. Although supply issues and staff shortages continue to hamper growth in the sector, production rose at the end of last year and output ticked up across the consumer, intermediate and investment goods sectors.

Despite inflationary pressures and higher prices being passed onto customers, many participating companies kicked off the year on a positive footing, with the majority of firms (63%) expecting production to increase in 2022, a favourable comparison to the 6% of respondents predicting contraction. This largely positive outlook reflects expectations of renewed global economic growth, planned investment activity and hopes for less disruption from the pandemic, Brexit and supply chain issues.

Rob Dobson, Director at IHS Markit, commented on the findings, “UK manufacturing production rose at the quickest pace in four months in December, supported by increased intakes of new work, efforts to reduce backlogs of work and higher employment. While the uptick in growth is a positive step, the upturn remains subdued compared to the middle of the year.”

He continued, “Although supply chains remain severely stretched, there are at least signs that the situation is stabilising, with vendor delivery times lengthening to the weakest extent for a year in December. This helped take some of the heat out of input price increases, but cost inflation remained sufficiently steep to necessitate the sharpest rise in factory gate selling prices on record. With restrictions and Omicron cases both rising, the growth and inflation backdrops could change again in the early part of 2022.”

Oil on a roll

After the brutal impact of the pandemic on oil demand and pricing, a positive stance was expressed by the Organization of the Petroleum Exporting Countries and allies (OPEC+) last week, when it signalled an expectation that the Omicron variant will only have only a ‘mild and short-lived’ limited impact on oil demand. This viewpoint prompted them to continue with the planned 400,000 barrels-per-day production increase due to commence next month. Brent crude rose above $80 a barrel last week for the first time since November following the announcement. As OPEC maintains a firm grip on supply, it seems that many oil producers are planning to carefully control capital spending this year despite the price rebound.

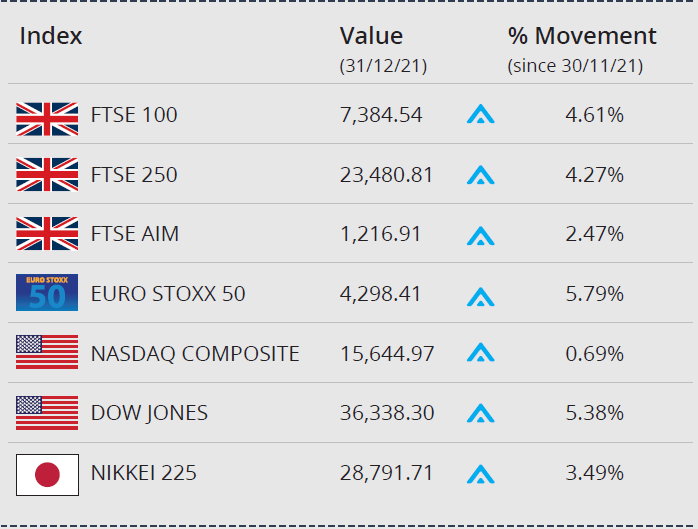

Markets update

In the UK, travel companies were lifted on last week’s news that pre-departure travel tests will end for fully vaccinated travellers and day two PCRs will be replaced by lateral flow tests. The overhaul of the system came after travel firms said the measures were ineffective due to the worldwide spread of Omicron. After a lacklustre start to the week on Monday, the FTSE 100 closed Tuesday on 7,488.09, led by fashion retailers, Next and JD Sports, as well as mining companies and gambling firms.

US indices closed out the first trading week of the year in the red as investors considered the latest labour report, and the economic impact staff shortages is having. The December Federal Reserve minutes, also released last week, indicated that some officials were inclined to speed their asset-purchase tapering and bring forward an initial interest rate hike. Wall Street’s main indices advanced on Tuesday, after Federal Reserve Chairman Jerome Powell told congress, “If we see inflation persisting at high levels, longer than expected, if we have to raise interest rates more over time, then we will.”

House prices see fastest growth for 17 years

According to the latest data from the Halifax, UK house prices rose at a faster rate in 2021 than in any calendar year since 2004, with prices increasing by 9.8%, taking the average UK property price to £276,091, which is an increase in cash terms of more than £24,500 compared to December 2020.

Russell Galley, Halifax’s Managing Director said, “The housing market defied expectations in 2021, with quarterly growth reaching 3.5% in December, a level not seen since November 2006. In 2021 we saw the average house price reach new record highs on eight occasions, despite the UK being subject to a lockdown for much of the first six months of the year.“

Here to help

Financial advice is key, so please do not hesitate to get in contact with any questions or concerns you may have.

The value of investments can go down as well as up and you may not get back the full amount you invested. The past is not a guide to future performance and past performance may not necessarily be repeated.