- All major Russian banks will have their assets frozen and be excluded from the UK financial system, inhibiting them from accessing sterling and clearing payments through the UK

- Russian companies and the state will be prevented from borrowing money or raising finance on UK markets

- A suspension of dual-use export licences to cover components which can be used for military purposes and ceasing exports of high-tech items and oil refinery equipment.

The top beauty spots for UK buyers

New research1 has revealed the UK’s top ten most sought-after beauty spots from the 46 areas of outstanding natural beauty across England, Wales and Northern Ireland and 40 national scenic areas across Scotland.

Country living

The Cotswolds leads the way, with houses in this area notching up over 8.5 million views on Zoopla in 2021. Homebuyers are attracted by its acres of open countryside, charming villages and an average property price of £474,164.

In second place is the Kent Downs with 8.25 million views and an average house price of £460,132, while the Chilterns ranks third with 7.27 million views and an average price of £613,200. High Weald, Cornwall, the Gower, the North Wessex Downs, the Surrey Hills, South Devon and the Wye Valley complete the top 10.

High and low

The rankings look slightly different when price is taken into account. The Surrey Hills is the most expensive area, with the average home costing £704,813, followed by the Chilterns and High Weald (£580,537). At the other end of the scale, the Scottish Highlands’ Kyle of Tongue was the least expensive beauty spot, with homes selling for £118,302 on average.

On the move?

If you’re in search of your own slice of paradise in 2022, we can help you find the most suitable mortgage finance for you.

1Zoopla, 2021

As a mortgage is secured against your home or property, it could be repossessed if you do not keep up mortgage repayments.

Investment terms trigger stress reaction

The common use of jargon can make investments and pensions seem impenetrable and intimidating. If the thought of words such as ‘Equities’ and ‘Investment ISAs’ gets your heart racing, you’re not alone: new research1 has shown that financial terms really can make people feel anxious.

How can this be tested?

Researchers used a variation of the Emotional Stroop Test, which measures information processing speed when naming the ink colour of different words, to compare response times for neutral words like ‘pencil’ with investment-specific terms like ‘ISA.’

Nearly two-thirds of participants had slower response times and higher error rates for financial trigger words, suggesting stress reactions. Additionally, 44.3% experienced a raised heart rate and 11.5% reported an increase in breathlessness.

The terms ‘Stockbroker’, ‘Asset Manager’ and ‘Investment Risk’ produced three of the slowest reaction times. Other investment-related words like ‘Bond Fund’ and ‘Equities’ also took longer than average.

Don’t have a fear of finance

Stripping back jargon can help people think more clearly about investments and pensions. In supporting research, Barclays found that 71% of respondents don’t feel confident enough to invest money in the stock market, with a quarter feeling ‘frightened’ by the idea.

Despite these fears, people do want to improve their financial knowledge, with three in five participants keen to learn more about financial terminology. We can relieve the stress of investments and pensions – and take the fear out of financial planning!

1Barclays, 2021

The value of investments and income from them may go down. You may not get back the original amount invested. A pension is a long-term investment. The fund value may fluctuate and can go down. Your eventual income may depend on the size of the fund at retirement, future interest rates and tax legislation.

Economic Review February 2022

Interest rates rise again

In February, the Bank of England’s Monetary Policy Committee (MPC) announced an increase in its main interest rate for the second meeting in a row as the Bank continues to grapple with a rapid rise in the cost of living.

At its latest meeting held in early February, the MPC sanctioned a quarter of a percentage point rate rise taking Bank Rate to 0.5%. In what was a surprise split decision, however, four of the nine-member committee voted for a larger hike, seeking to raise rates by half a percentage point.

The decision to increase rates is designed to contain the country’s spiralling rate of inflation, which the Bank now expects to peak at around 7.25% in April. This would represent the fastest rate of consumer price growth since 1991 and would leave inflation significantly above the Bank’s 2% target level.

Data subsequently released by the Office for National Statistics (ONS) showed that inflation, as measured by the Consumer Prices Index, rose to 5.5% in the 12 months to January, putting the cost of living at a near 30-year high. This figure was above most predictions in a Reuters poll of economists, with the consensus suggesting the rate would hold steady at the previous month’s level of 5.4%.

The latest inflation statistics appear to have reinforced the chances of a third consecutive rate rise at the conclusion of the MPC’s next meeting on 17 March. The minutes from February’s meeting acknowledged that the Bank expects ‘further modest tightening in monetary policy’ to be appropriate ‘in the coming months’ and, according to a Reuters poll, most economists now predict a quarter percentage point rise in March. Furthermore, almost half of respondents also forecast a similar hike at May’s meeting.

Signs of economic resurgence

The latest gross domestic product (GDP) statistics show the UK economy suffered a smaller than expected economic hit in December while more recent survey evidence points to a sharp acceleration in growth during February.

Data released last month by ONS revealed that UK economic output fell by 0.2% in December as people increasingly worked from home and avoided Christmas socialising due to the spread of the Omicron variant. This contraction, however, was less severe than many had feared, with a Reuters poll of economists having predicted a 0.6% monthly fall.

Despite December’s decline, GDP data covering the whole of last year showed the UK economy experienced a sharp rebound in 2021, following the dramatic pandemic-induced collapse in output recorded during the previous year. In total, the economy grew by 7.5% across 2021, the UK’s largest annual rate of growth since 1941.

More recent survey data also suggests there has been a swift rebound in economic activity following the disruption caused by Omicron at the turn of the year. The preliminary headline reading of the closely monitored IHS Markit/CIPS composite Purchasing Managers’ Index, for instance, rose to 60.2 in February from 54.2 in January.

This represents the fastest pace of growth in private sector output since last June, with a strong recovery in consumer spending on travel, leisure and entertainment fuelling the pickup in activity. IHS Markit’s Chief Business Economist Chris Williamson said the data pointed to a “resurgent economy in February” as COVID containment measures were relaxed.

Mr Williamson did though add a note of caution, saying that “indications of a growing plight for manufacturers” needed to be watched. He added, “Given the rising cost of living, higher energy prices and increased uncertainty caused by the escalating crisis in Ukraine, downside risks to the demand outlook have risen.”

Markets (Data compiled by TOMD)

The Russian invasion of Ukraine has understandably impacted global markets. Due to the uncertain nature of the fast-evolving situation, global markets initially reacted with many stocks moving into the red and the oil price pushing beyond the $100 milestone as supply concerns intensified.

Markets reacted accordingly on the last trading day of the month following news that Vladimir Putin had placed the nuclear deterrent on high alert the previous day. A raft of economic sanctions against Russia are being imposed, including a move designed to cut off Moscow’s major financial institutions from Western markets. Chancellor Rishi Sunak said the sanctions “demonstrate our steadfast resolve in imposing the highest costs on Russia and to cut her off from the international financial system so long as this conflict persists.”

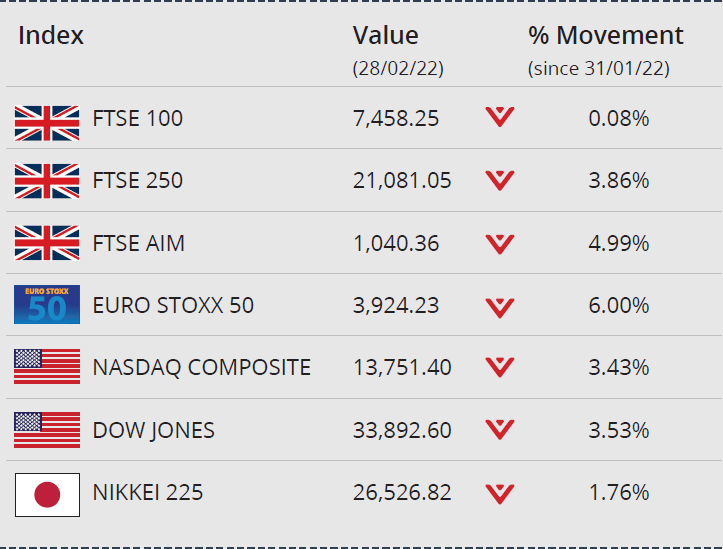

At the end of February, major global markets largely closed in negative territory as investors pensively monitored developments. In the UK, the FTSE 100 closed the month down 0.08% on 7,458.25, the FTSE 250 and AIM also both lost ground to close the month on 21,081.05 and 1,040.36, losses of 3.86% and 4.99% respectively.

In Japan, the Nikkei 225 ended the month on 26,526.82, down 1.76%, and the Euro Stoxx 50 closed February down 6.00% on 3,924.23. Stateside, the Dow Jones closed February down 3.53%, while the NASDAQ closed down 3.43%.

On the foreign exchanges, sterling closed the month at $1.34 against the US dollar. The euro closed at €1.19 against sterling and at $1.12 against the US dollar.

The oil price moderated at month end with Brent Crude closing the month trading at around $98 a barrel, a gain of over 9%. Investors flocked to gold, which is currently trading at around $1,903 a troy ounce, a gain of over 6% on the month.

Pay levels fall in real terms

While the latest set of earnings statistics did report relatively strong growth in nominal wage levels, the data also showed that pay growth is now lagging the rapidly rising cost of living.

ONS figures released last month showed that average weekly earnings, excluding bonuses, rose at an annual rate of 3.7% in the final quarter of last year. This exceeded market expectations and was also higher than Bank of England forecasts.

However, although the rate remains relatively high in comparison to levels witnessed over the last decade, pay growth is now failing to keep up with the spiralling rate of inflation. Indeed, in real terms, regular earnings fell by 0.8% compared to Q4 2020.

In early February, after announcing the latest interest rate rise, Bank of England Governor Andrew Bailey called on workers to rein in pay demands or risk a wage-inflation spiral. The tight labour market, however, means employers are increasingly having to offer higher salaries to retain existing workers and attract new staff. Early ONS estimates suggest these pressures are driving wage growth, with median earnings for workers on payrolls in January 6.3% higher than the same month last year.

Government debt costs rising

The latest public sector finance statistics show borrowing remains below forecast, although rising inflation is pushing up the cost of servicing government debt.

January is typically a strong month for public finances due to seasonal inflows of Income Tax and this year ONS data revealed a £2.9bn surplus. While this was a distinct improvement on last year’s £2.5bn deficit, it was below market expectations and £7bn less than January 2020’s pre-pandemic surplus.

While year-to-date borrowing remains significantly ahead of Office for Budget Responsibility forecasts prepared for the last Budget, higher inflation has started to push up interest payments via its impact on index-linked debt. Economists expect this to limit the Chancellor’s room for manoeuvre when he delivers a fiscal update on 23 March.

Isabel Stockton, a Research Economist at the Institute for Fiscal Studies, commented, “Borrowing remains likely to come in below that forecast in the Budget. This will doubtless be good news for the Chancellor as he prepares for his Spring Statement. But borrowing still remains high by historical standards and while he is currently meeting his fiscal targets, Mr Sunak has left himself with very little wriggle room.”

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.

News in Review

“Falling COVID cases and the slow return to offices offer further hope for town and city centres”

Storms Dudley, Eunice and Franklin swept the country over the last week or so, causing major disruption. With trains and flights cancelled, schools and venues closed, people were urged to avoid travel and to stay at home. The economic impact will no doubt be felt as people hunkered down to stay safe.

Some positive UK retail data released on Friday from the Office for National Statistics (ONS) detailed a sales rebound of 1.9% in January as shoppers returned to the High Street following the disruption caused by Omicron the previous month, when retail sales volumes fell by 4.0%. This increase was the largest monthly rise since shops reopened last spring.

Looking at the data, ONS Director of Economic Statistics Darren Morgan commented from a sector perspective, “It was a good month for garden centres, department and household goods stores, with particularly strong trading for furniture and lighting. Food sales fell below their pre-pandemic level for the first time, though, as more people returned to eating out and there was also anecdotal evidence suggesting higher demand for takeaways and meal-subscription kits.”

The rise in High Street footfall meant that the proportion of online sales (25.3%) dropped to its lowest level since March 2020 (22.7%). Although a continuation of a downward trend, the percentage of retail sales made online was still higher than prior to the pandemic (19.8% in February 2020).

Chief Executive of the British Retail Consortium, Helen Dickinson, commented on the recent dataset, “Despite falling consumer confidence, retail sales held up well in January as retailers went to great lengths to keep up the Christmas momentum… Falling COVID cases and the slow return to offices offer further hope for town and city centres that were hardest hit by the pandemic. Yet, rising inflation means households may be preparing for future falls in disposable income, including from April’s National Insurance and energy price cap rises. Retailers face similar challenges, with increases in transport and energy costs, global commodity prices and domestic wages. While retailers are going to great lengths to mitigate or absorb these cost increases, it is inevitable that prices will rise further in the future.”

Over three quarters feeling the pinch

As cost of living issues intensify, new rapid response survey data on economic activity and social change from ONS showed that in the ten-day period to 13 February, 76% of adults reported their cost of living had increased over the last month, up from 69% in the previous period (19 to 30 January 2022). The most frequently reported reasons continued to be rising food prices (90%), rising energy bills (77%) and increases to the price of fuel (69%). In addition, rent rises are adding to the burden for millions; average rental costs for UK tenants increased by 2% last year, the largest annual increase since 2017. The East Midlands saw the biggest increase in average rental prices, with tenants paying 3.6% more than a year earlier, while London had the smallest increase, at 0.1%.

Markets

The markets were as changeable as the weather last week, European stock markets closed in the red on Friday as storm Eunice battered parts of the UK and Europe, driving down power prices and lifting wind turbine output to some of the highest levels ever seen. As tensions mounted over the worsening situation in Ukraine and the threat of military action by Russia, gold prices jumped to an eight-month high and oil prices climbed on fears that the crisis will disrupt global supplies. Brent crude oil reached a seven-year high of $99.38 a barrel on Tuesday, before moderating to end the day at just under $97 a barrel.

All change

On Monday night at a Downing Street briefing, Boris Johnson announced his ‘Living with COVID-19’ plan, which stated that all legal restrictions would end later this week and free testing for the general public will stop from 1 April. In Scotland, Nicola Sturgeon announced on Tuesday that the COVID passport scheme will end on 28 February, with the legal requirement to wear face masks being lifted on 21 March.

Here to help

Financial advice is key, so please do not hesitate to get in contact with any questions or concerns you may have.

The value of investments can go down as well as up and you may not get back the full amount you invested. The past is not a guide to future performance and past performance may not necessarily be repeated.

Commercial Property Market Review – February 2022

Upbeat mood for regional office activity

The regional office investment market remains upbeat, according to the latest quarterly update from Avison Young, after office demand across the ‘Big Nine’ returned to ‘normal’ activity in H2 2021.

A strong second half brought the year’s total take-up across the Big Nine cities to 8.1 million sq. ft, only 5% below the ten-year average. Volumes for the Big Nine office markets, meanwhile, recovered to £2.6bn, 8% above the ten-year average. Although the total number of deals slowed in Q4 2021, NatWest acquired One Hardman Boulevard in Manchester for £292m, the largest deal of the year.

Prime yields for most cities were unchanged in the final quarter, with an average of 5.36%. The MSCI quarterly index did, however, show the yield gap between prime and secondary property widening, highlighting a shift towards the best quality assets.

Mark Williams, Principal and Managing Director of Regional Investment at Avison Young commented, “Well-located, good quality assets with a strong tenant base continue to receive good levels of interest, particularly those that meet net zero carbon investment criteria and fulfil expectations for positive rental growth.”

Rosy picture for investment expectations

UK real estate professionals reported positive investment trend movements during Q4, in line with a global uplift in sentiment observed in the latest Royal Institution of Chartered Surveyors (RICS) Global Commercial Property Monitor (GCPM).

The GCPM showed UK capital value expectations for the next year rising across all sectors. Top of the list is the industrial sector; a net balance of +84% of respondents expect prime industrial values to increase.

Prime office value expectations also rose, with a net balance of +24% anticipating an increase. With work-from-home restrictions now lifted, two-thirds of respondents believe an office is still essential to successful operations. At the same time, 76% of contributors noted rising demand for flexible and local workspaces.

Tarrant Parsons, RICS Economist, commented, “Strength across the UK industrial/logistics market shows no sign of abating, with capital value expectations for the year ahead posting a fresh all-time high across the sector during Q4… sentiment appears to have largely weathered the uncertainty brought on by the rapid spread of the Omicron variant in recent weeks.”

Industrials and retail warehousing are star Scottish performers

Industrial property and retail warehousing have surpassed offices in annual volumes for the first time since 2011, with combined investments of £541m, figures released by Knight Frank have revealed.

The pair contributed nearly a third of the year’s total investments, a 45% increase on £374m in 2020. Overall, investments in Scottish commercial property reached £1.7bn in 2021, above the £1.4bn recorded in 2020. Glasgow led the way with £475m, ahead of Edinburgh (£429m) and Aberdeen (£54m).

Knight Frank’s Alasdair Steele highlighted the “almost insatiable appetite for retail warehousing and industrial property driven by changes to people’s shopping habits”, adding that this “only looks likely to continue in 2022.”

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.

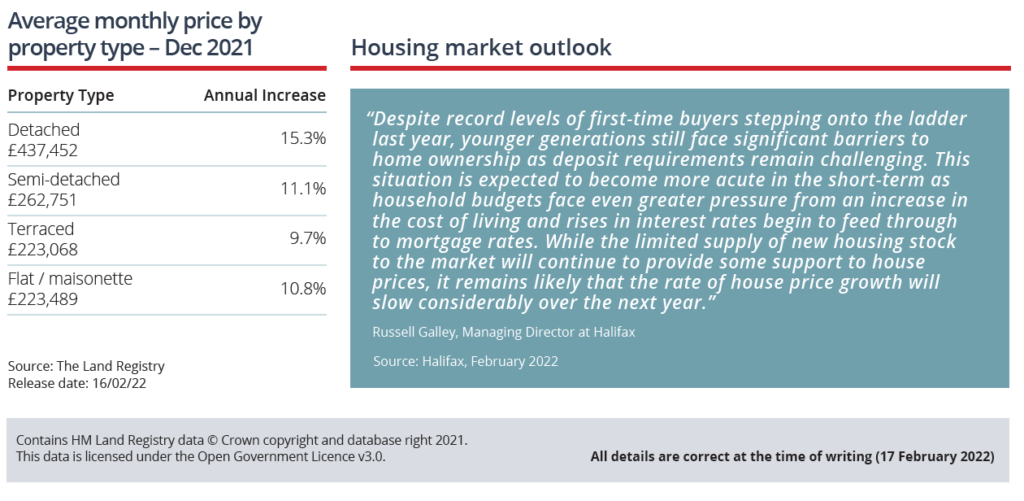

Residential Property Review – February 2022

Promising signs in the UK housing market

Following a record-breaking 2021, continuing strong numbers of agreed sales and approved mortgages suggest transactions are likely to stay high over the next few months.

Net mortgage debt by individuals decreased slightly to £3.6bn in December 2021, according to the Bank of England. However, agreed sales and approved mortgages both remained ahead of pre-pandemic levels, the former being 11% above its 2017-19 average, according to TwentyCi.

Although new instructions remained in negative territory, the latest net balance (-8%) is the least negative since April 2021, according to the Royal Institution of Chartered Surveyors (RICS), a sign that persistently high buyer demand may soon come up against marginally higher available stock. Moreover, new instructions rose above the 2017-19 average in the last week of January, the first time this has happened since May 2021.

The rental market looks strong too, with rents rising by 7.4% nationwide in the year to November 2021, according to Zoopla. South West England saw the strongest rental growth (9.6%).

The Bank of England’s decision to increase Base Rate to 0.5% will have little immediate impact on existing homeowners on fixed-rate mortgages, analysts expect. Instead, it is first-time buyers, many of whom rely on higher loan-to-value mortgages which are more sensitive to rate changes, who could be harder hit.

Demand climbs higher across the board

UK Housing demand in January was 49% higher than the previous four year average, according to Zoopla, as pandemic trends spilt over into 2022.

Buyers’ desire for family houses soared even higher than during the final six months of the Stamp Duty holiday, signalling that the race for space, that characterised much of 2021, has not yet run its course. Last month, demand for family homes outside London was four times higher than the five-year average.

Flats were also popular at the start of 2022, with demand reaching its highest level for five years, propelled by the return of workers to the office.

Gráinne Gilmore, Head of Research at Zoopla, commented, “Even after nearly two years, the pandemic-led ‘search for space’ is one of the factors creating record demand for homes this month. The market is also being boosted by office-based workers re-thinking where and how they are living amid more hybrid working models.”

Housebuilders think build costs will keep rising

More than nine in 10 housebuilders expect the cost of building work on homes in England to increase in 2022, with a quarter predicting building costs will ‘increase significantly’ according to Knight Frank’s latest survey.

Nearly half of survey respondents said that last year’s build cost increases had already had a significant impact on their businesses. Similarly, 56% said that build costs were the primary factor adding pressure to their bottom line.

The increased cost of materials (65%) is seen as the main cause of rising build costs, ahead of Brexit-related complications (15%) and labour challenges (8%).

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.

News in Review

“GDP grew robustly across the fourth quarter as a whole”

With the dust settling on the recent rise in Bank Rate and an increase in springtime inflation expectations, some positive news was released at the tail end of last week in the form of Q4 GDP data. The official statistics from the Office for National Statistics (ONS) show that GDP increased by an estimated 7.5% in 2021, following a 9.4% fall in 2020. Despite a fall back in December due to Omicron related restrictions, this was the fastest pace of growth in over 80 years.

The estimate exceeded analysts’ expectations which averaged 7.3% for Q4. However, ONS was keen to emphasise that owing to the challenges faced making estimates in the current conditions, their GDP estimate for Q4 is subject to more uncertainty than usual. Director of Economic Statistics at ONS Darren Morgan commented on the dataset, “GDP fell back slightly in December as the Omicron wave hit, with retail and hospitality seeing the biggest impacts. However, these were partially offset by increases in the Test and Trace service and vaccination programmes. Despite December’s setback, GDP grew robustly across the fourth quarter as a whole, with the NHS, couriers and employment agencies all helping to support the economy.”

The data meant the UK posted the fastest growth in the G7, beating growth in the US, which came in at 5.7%, France and Germany at 7% and 2.7% respectively, and Italy at 6.5%.

BCC plea for support

The results of a business survey recently conducted by the British Chambers of Commerce (BCC) make compelling reading, with UK firms expressing concerns over an array of cost pressures – just as households are feeling the squeeze, so too are businesses.

The key headline stats from the survey identify that almost three quarters (73%) of firms are increasing prices in response to rising costs and 62% pinpoint higher energy bills as a primary factor (rising to 75% for manufacturers). Meanwhile, almost two thirds (63%) cite increased wage bills as a key factor driving their prices higher.

The BCC is calling on the Chancellor to ease the mounting pressure on businesses by implementing a series of measures. Suggested measures include a temporary energy price cap for small businesses, a one-year delay to the planned National Insurance hike in April, a halt to any potential business taxes or cost increases, and extra financial support through the expansion of the energy bills rebate scheme for households to also include small firms and energy intensive businesses.

Director General of the BCC Shevaun Haviland commented, ”Without help from the Treasury to weather this storm many businesses, especially smaller ones, will be faced with a nearly impossible situation that will leave them with little choice but to raise prices… Unabated, the surging cost pressures produced by the cost-of-doing-business crisis will continue to lead to increased prices and fuel the cost-of-living crisis currently being faced by people across the country.”

Gradual rate increase favoured

Speaking last week, Huw Pill, Chief Economist at the Bank of England (BoE) expressed his belief that policymakers should gradually increase interest rates as opposed to adopting an aggressive approach. When talking about the expected income squeeze in the coming months, he confirmed his support for the hard-hitting message conveyed by BoE Governor Andrew Bailey last week, when he cautioned that wages would need to fall in real terms this year to control inflation.

Job vacancies at record high

Job vacancies in the last quarter hit another record of almost 1.3 million, according to latest data from ONS. Wages rose by 3.7% during this period but, when taking inflation into account, fell by 0.8% in real terms from a year earlier.

Markets update

After the US and UK advised citizens to leave Ukraine amid fears of a Russian invasion, uncertainty weighed on markets. Global stocks bounced back on Tuesday as concerns eased following Russian claims that 100,000 troops were returning to bases following training exercises.

The global benchmark for oil, Brent Crude, traded above $96 a barrel on Monday, its highest in seven years, before dropping back on Tuesday to around $93 a barrel. Fuel prices continue to soar at the pumps, with the AA reporting a record high of 148p a litre on Sunday.

Here to help

Financial advice is key, so please do not hesitate to get in contact with any questions or concerns you may have.

The value of investments can go down as well as up and you may not get back the full amount you invested. The past is not a guide to future performance and past performance may not necessarily be repeated.

The fine print of home insurance T&Cs

Few people enjoy reading the fine details of insurance terms and conditions. However, failing to do so can leave you with insufficient cover or, in the worst cases, the wrong type altogether.

Cost, time or font?

A fifth of UK adults admit to not checking the T&Cs before taking out insurance. The explanations are varied: a quarter of respondents to a recent survey1 said the T&Cs were too long, while 17% said they only care about the cost, not the details. 15% said they don’t have time to worry about the detail, and 6% were put off because the writing was too small.

Just under a fifth said they occasionally read the T&Cs of their home cover, while a hearteningly high 50% said they always check the small print.

We can help

It can end up costing you a lot more if you take out an insurance policy without checking the fine print. We can help make sure you have the right level and type of cover in place.

1Go Compare, 2021

As a mortgage is secured against your home or property, it could be repossessed if you do not keep up mortgage repayments.

Climate disclosures top corporate agendas in 2022

Regulators have been urged by the IMF to do more to prevent financial companies from making misleading claims concerning their environmental credentials – ‘Proper regulatory oversight and verification mechanisms are essential to avoid greenwashing.’ To achieve the expansion needed to reach the target of reducing worldwide carbon emissions to net zero by mid-century, will require a proper understanding by investors how their money is used.

From April the UK’s biggest companies will be required to make climate-related financial disclosures. Firms with a turnover in excess of £500m and at least 500 employees are expected to publish the climate-related risks they face. With the UK the first G20 country to make this compulsory, John Glen, Economic Secretary to the Treasury commented, “These requirements will not only help tackle greenwashing but also enable investors and businesses to align their long-term strategies with the UK’s net-zero commitments.”

The requirements for disclosure will be aligned to the Task Force on Climate-Related Financial Disclosures, backed by over 1,000 global financial institutions, and responsible for over $190trn of assets. Companies will need to “focus on the effects of climate change on their business” and communicate to investors how these are being managed, according to Chris Cummings, Chief Executive of the Investment Association.

The value of investments and income from them may go down. You may not get back the original amount invested.