Last month, the Bank

of England (BoE) sanctioned a further increase in its benchmark interest rate

as inflation continues to surge significantly ahead of the Bank’s target level.

Following

a meeting held in mid-March, the BoE’s nine-member Monetary Policy Committee

(MPC) voted by an 8-1 majority to raise Bank Rate from 0.5% to 0.75%. This was

the third meeting in a row that the MPC had signalled a tightening of monetary

policy, taking the Bank’s main interest rate back to its pre-pandemic level.

Policymakers

cited a strong labour market and continuing signs of ‘robust domestic cost

and price pressures’ as key reasons for the hike. Minutes to the meeting

also noted that Russia’s invasion of Ukraine had led to ‘further large

increases in energy and other commodity prices including food prices.’ As a

result, the BoE now expects inflation to reach ‘around 8% in April,’

almost a full percentage point higher than it forecast in February and four

times its 2% target figure.

While

the minutes did say that ‘some further modest tightening in monetary policy

may be appropriate in the coming months’ they also pointed to concerns

about the outlook for growth as households struggle with a squeeze on incomes.

Indeed, analysts noted a more dovish tone than was evident in the previous set

of minutes, with a distinct softening of the language on the need for future

rate hikes.

Data

subsequently released by the Office for National Statistics (ONS), however,

showed that price rises continue to exceed analysts’ expectations. In the 12

months to February, the rate of inflation as measured by the Consumer Prices

Index, surged to a 30-year high of 6.2%. This was significantly up on the

previous month’s rate of 5.5%, and 0.3% higher than the median forecast in a

Reuters poll of economists.

OBR

downgrades growth forecast

The

Office for Budget Responsibility (OBR) has downgraded its forecast for UK

economic growth over the next two years amid an unprecedented squeeze on

household finances.

Chancellor

Rishi Sunak unveiled the independent forecaster’s revised projections during

his Spring Statement, delivered to the House of Commons on 23 March. The new

forecast suggests the economy will expand by 3.8% in 2022, significantly down

on October’s 6.0% prediction. Next year is also expected to yield lower growth,

with the economy forecast to expand by 1.8% compared to a previous prediction

of 2.1%.

The

downgrades partly relate to Russia’s invasion of Ukraine which the OBR warned

would have ‘major repercussions for the global economy.’ In addition,

they reflect a sharp squeeze on living standards with real disposable household

incomes expected to fall by 2.2% in the coming financial year – this would

represent the biggest annual decline in UK living standards since records began

in 1956.

Ironically,

the latest gross domestic product statistics released by ONS showed the UK

economy grew by a faster than expected 0.8% in January. This was the strongest

monthly expansion since last June and beat all forecasts in a Reuters poll of

economists.

Survey

data also suggests the economy continued to expand at a robust pace during the

last two months. The preliminary reading of the S&P Global/CIPS Composite

Purchasing Managers’ Index (PMI), for instance, came in at 59.7 in March, only

marginally below February’s historically high figure of 59.9.

S&P

Global Chief Business Economist Chris Williamson said, “The further

reopening of the economy after COVID-19 containment measures helped offset

headwinds from the Ukraine war, Brexit and rising prices.” However, he also

noted that the PMI’s measure of business optimism slumped to a 17-month low in

March, adding, “Indicators point to potentially sharply slower growth in the

coming months.”

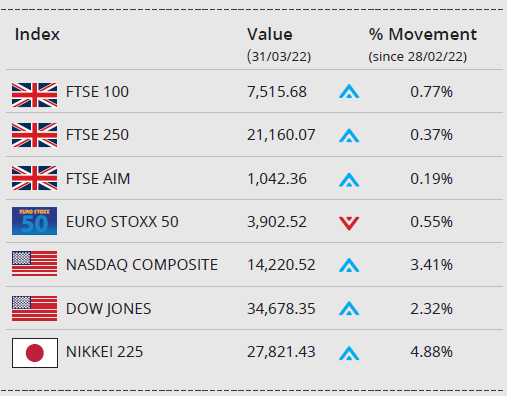

Markets

(Data compiled by TOMD)

The

ongoing conflict in Ukraine continues to impact global markets, as they closed out a turbulent quarter. The invasion is

exacerbating inflationary pressures, driving up the cost of everything from

fuels to food, leading to volatility across commodity markets in particular.

At the end of March, falling oil prices

and escalating inflation figures from the US weighed on investor sentiment. The oil price declined

after the

Organization of the Petroleum Exporting Countries and allies (OPEC+)

agreed to another modest monthly oil output boost, resisting pressure to pump

more oil, despite consumer calls for increases. Joe Biden later issued the release of

one million barrels a day from crude reserves in an effort to tame energy costs,

commencing in May.

Looking at major global

indices, in the UK, as the dust

settles on the Spring Statement and recent OBR estimates, the FTSE

100 closed the month up 0.77% on 7,515.68, while the FTSE 250 and AIM both

recorded marginal gains of 0.37% and 0.19% respectively. In

the

US, the Dow Jones closed March up 2.32%, while the NASDAQ finished 3.41% up. In Japan, the

Nikkei 225 ended the month on 27,821.43, up 4.88%, and the Euro Stoxx 50 closed

March down 0.55% on 3,902.52.

On

the foreign exchanges, sterling closed the month at $1.31 against the US

dollar. The euro closed at €1.18 against sterling and at $1.10 against the US

dollar.

Brent Crude closed the month trading at around $108 a barrel, a gain of over 10%. Gold is currently trading at around $1,924 a troy ounce, a gain of just over 1% on the month.

Unemployment

below pre-pandemic rate

The latest set of

labour market statistics published by ONS revealed a further fall in the rate of

unemployment, although real pay growth continues to lag the spiralling cost of living.

In the

three months to January, the unemployment rate fell to 3.9%, down from 4.1%

across the previous three-month period. This was the lowest level since the

three months to January 2020 and took the jobless rate back below its

pre-pandemic level.

The data

also showed another strong rise in the number of pay-rolled employees in

February and yet another record number of job vacancies. The number of people

out of work but not looking for a job also rose again, however, which meant the

total number of people in employment remains well below its equivalent

pre-pandemic figure.

In terms of

wage growth, the data showed average weekly earnings, excluding bonuses, rising

at an annual rate of 3.8% across the November–January period. Although this was

a slight increase from the previous three-month period, it did mean that pay

once again failed to keep up with the rapid rise in prices. Indeed, after

taking account of inflation, regular earnings fell by 1% compared to year

earlier levels.

Official retail sales

figures have revealed a drop in sales volumes during February while survey

evidence suggests sales remained disappointing in March.

ONS

data showed that total retail sales volumes unexpectedly declined by 0.3% in

February compared to the previous month. An ONS spokesperson said retailer

feedback linked some of the fall to stormy weather which had kept shoppers at

home, while the easing of COVID restrictions resulted in more people returning

to pubs and restaurants at the expense of grocery sales.

The

latest Distributive Trades Survey from the CBI suggests sales growth remained

relatively weak last month with its sales-for-the-time-of-year gauge falling

from +16 in February to -23 in March. Retailers also said they expect sales to

remain below seasonal norms this month, although to a lesser extent.

Commenting

on the findings, CBI Principal Economist Martin Sartorius said, “Retailers

had a mediocre March, with sales reported as being below seasonal norms. The

cost-of-living crisis is looming large across the sector, as households’

wallets are being hit by the fastest rate of inflation in decades. Further

action will be needed to galvanise consumer confidence, shore up incomes, and

support spending on UK high streets in the tough months to come.”

It

is important to take professional advice before making any decision relating to

your personal finances. Information within this document is based on our

current understanding and can be subject to change without notice and the

accuracy and completeness of the information cannot be guaranteed. It does not

provide individual tailored investment advice and is for guidance only. Some

rules may vary in different parts of the UK. We cannot assume legal liability

for

any

errors or omissions it might contain. Levels and bases of, and reliefs from,

taxation are those currently applying or proposed and are subject to change;

their value depends on the individual circumstances of the investor. No part of

this document may be reproduced in any manner without prior permission.