Chancellor’s

fiscal statement delayed

The

government has pushed back the date of its much-anticipated Medium-Term Fiscal

Plan in order to ensure it is based on the “most

accurate” economic forecasts available.

Chancellor Jeremy Hunt had been due to

deliver his first fiscal statement detailing how the government plans to repair

the country’s public finances on 31 October, but following Rishi Sunak’s

appointment as Prime Minister, it was decided to move the announcement back by

two-and-a-half weeks.

The fiscal event, which will now be delivered

on 17 November, has also been upgraded to a full Autumn Statement, paving the

way for wider taxation policies to be announced. The Chancellor’s tax and

spending plans will also be accompanied by updated economic growth and

borrowing forecasts produced by the independent Office for Budget

Responsibility (OBR).

When announcing the postponement, Mr Hunt

said, “Our number one priority is

economic stability and restoring confidence that the United Kingdom is a country

that pays its way. I’m willing to make choices that are politically

embarrassing if they’re the right thing to do for the country, if they’re in

the national interest.”

Financial markets were relatively calm after

the news broke with analysts describing the delay as understandable, and both

sterling and government bond prices were little changed by the announcement.

The International Monetary Fund, which had criticised the previous Chancellor’s

unfunded tax cuts, offered support to the incoming Prime Minister, with the

organisation’s Chief Kristalina Georgieva suggesting Rishi Sunak will bring “fiscal discipline” to the UK.

The

Chancellor has been keen to demonstrate his fiscal credentials, reiterating his

commitment to “debt falling over the

medium term.” This suggests the government will have some tough tax and

spending decisions to make in order to fill the budget black hole, with

Treasury officials warning people “should

not underestimate the scale of this challenge.”

Inflation back at 40-year

high

Soaring food prices

have pushed the UK inflation rate back to a four-decade high, fuelling

expectations of a sharp interest rate hike at the

next Bank of England (BoE) Monetary Policy Committee (MPC) meeting in early

November.

Data

released last month by the Office for National Statistics (ONS) showed that the

headline rate of inflation rose to 10.1% in September after dipping to 9.9% in

August. This was slightly above analysts’ expectations and took consumer price

inflation back to a 40-year high previously hit in July.

The

food and non-alcoholic drinks sector was the biggest upward contributor to

September’s rise, with prices in this category recording their biggest jump

since April 1980. ONS said the price of most key items in an average

household’s food basket rose, including fish, sugar, fruit and rice, as the war

in Ukraine and recent weakness in the pound made both food products and

ingredients more expensive.

This

further jump in inflation has placed additional pressure on the BoE to raise

interest rates when its next MPC meeting concludes on 3 November. Speaking at a

G30 event in Washington in mid-October, Bank Governor Andrew Bailey

acknowledged rates may need to rise by more than the BoE had previously

envisaged. The Governor said, “We will

not hesitate to raise interest rates to meet the inflation target. And, as

things stand today, my best guess is that inflationary pressures will require a

stronger response than we perhaps thought in August.”

While

the Chancellor’s decision to delay his fiscal statement until after the Bank’s

November meeting will make policymakers’ deliberations more difficult, analysts

still expect them to take decisive action. Indeed, over half of respondents in

a recent Reuters poll of economists expect rates to rise by 0.75% in November,

with most of the others predicting a 1% increase.

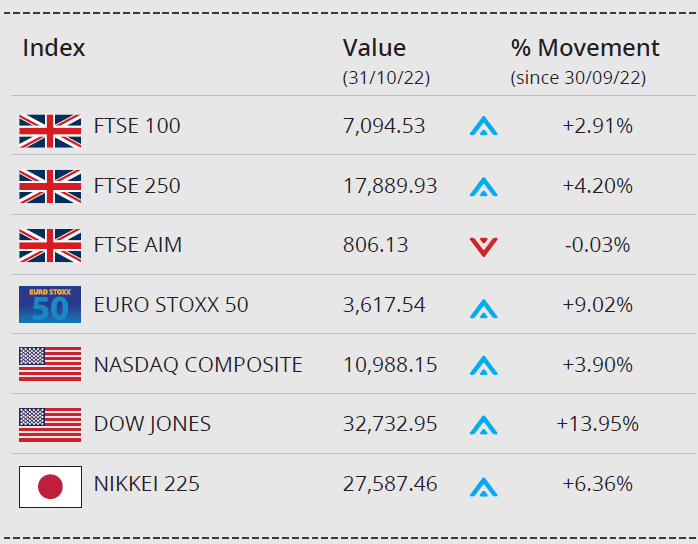

Markets (Data compiled by TOMD)

As October drew to a close, UK stock markets benefited

from a Halloween rebound. The blue-chip FTSE 100 index closed the month at a

five-week high, up 2.91% to 7,094.53, buoyed by gains across Britain’s high street banks, amid

expectations of an imminent Bank Rate rise. The FTSE 250 registered a gain of 4.20%, while the FTSE AIM ended October

with a small loss of 0.03%.

On the continent, the Euro Stoxx 50 closed

the month up 9.02%. Eurozone annual inflation reached a record

high of 10.7% in October, ahead of analyst expectations of 10.3%. In Japan, the

Nikkei 225 closed October on 27,587.46, up 6.36%. The Bank of Japan has chosen to

maintain ultra-low interest rates, bucking the tightening trend among global

central banks.

Across the pond, earnings season is in full swing and US markets

are awaiting the highly anticipated Federal Reserve rates meeting in early

November. Following a challenging September, markets made a comeback in October,

with the

Dow closing the month up 13.95% on 32,732.95, its best monthly advance since

January 1976. Meanwhile the tech-orientated Nasdaq closed October on 10,988.15, up 3.90%.

On the foreign exchanges, the euro closed at €1.16 against

sterling. The US dollar closed the month at $1.14 against sterling and at $0.98

against the euro.

Gold is currently trading at around $1,639 a troy ounce, a loss of 1.96% on the month. Pressure from anticipated rate hikes, rising yields and the relative strength of the dollar are weighing on the precious metal. Brent Crude closed the month trading at around $91 a barrel, a gain of 7.05%, following a decision by the Organization of the Petroleum Exporting Countries (OPEC+) alliance to make sizable cuts to output from November.

UK

economy unexpectedly shrinks

Growth

statistics released by ONS show the economy unexpectedly contracted in August

while forward-looking indicators point to further deterioration following the

country’s recent political and market turmoil.

According to the latest gross domestic

product (GDP) figures the UK

economy shrank by 0.3% in August with output in both the production and

services sectors falling back. ONS noted that a number of customer-facing

businesses, including retail, hairdressers and hotels, had all fared ‘relatively poorly’ during the month.

August’s figure was significantly weaker than

analysts’ expectations, with the consensus from a Reuters poll of economists

pointing to zero growth. July’s GDP figure was also revised down to 0.1% from a

previous estimate of 0.2%; as a result, output across the three months to

August as a whole fell by 0.3%.

Analysts have warned that September could see

an even sharper decline, partly due to the extra Bank Holiday to mark the

Queen’s funeral and reduction in business opening hours during the period of

mourning. Recent survey

evidence also suggests the downturn is set to intensify, with October’s

preliminary headline reading of S&P Global’s Purchasing Managers’ Index

showing the pace of economic decline ‘gathered

momentum after the recent political and financial market upheavals.’

Unemployment

rate falls again

The latest labour

market statistics showed that the rate of unemployment in the UK declined to

its lowest level in nearly 50 years, driven by an increase in the number of

people leaving the workforce.

ONS

figures showed the unemployment rate

fell to 3.5% in the three months to August, its lowest level since December to

February 1974. This decline, however, was due to an increase in the number of

working-age adults who are neither working nor looking for work.

The

economic inactivity rate, which measures the proportion of 16 to 64-year-olds

who are not in the labour force, rose to 21.7% in the June to August period, an

increase of 0.6 percentage points

from the

previous quarter. This rise was partly driven by an increase in student

numbers, as well as a rise in the number of people suffering with a long-term

illness, which rose to a record high.

This

resulted in the ratio of

unemployed people to job vacancies dropping to a record low, despite the latest

data revealing a decline in the total number

of vacancies. ONS noted that the fall in vacancies was due to a number of

employers reducing recruitment ‘due to a

variety of economic pressures.’

All details are correct at the time of writing (01

Nov 2022).

It

is important to take professional advice before making any decision relating to

your personal finances. Information within this document is based on our

current understanding and can be subject to change without notice and the accuracy

and completeness of the information cannot be guaranteed. It does not provide

individual tailored investment advice and is for guidance only. Some rules may

vary in different parts of the UK. We cannot assume legal liability for any

errors or omissions it might contain. Levels and bases of, and reliefs from,

taxation are those currently applying or proposed and are subject to change;

their value depends on the individual circumstances of the investor. No part of

this document may be reproduced in any manner without prior permission.