OBR

forecasts long but shallow recession

Updated

projections from the Office for Budget Responsibility (OBR) suggest the UK is

facing a long but relatively shallow recession which will see households hit by

a record drop in living standards.

Chancellor

Jeremy Hunt unveiled the independent fiscal watchdog’s latest forecasts during

his Autumn Statement delivered to the House of Commons on 17 November. Mr Hunt

said the country was facing “unprecedented

global headwinds” before announcing the OBR’s new figures which show the UK

entered recession during the third quarter of this year.

The

updated predictions suggest the UK economy will expand by 4.2% across the whole

of 2022, but then shrink by 1.4% next year before returning to growth in 2024.

This implies that the downturn will be relatively shallow, if long by historic

standards.

Although

the recession is forecast to be comparatively shallow for the economy as a

whole, the household sector is expected to be hit particularly hard due to a

combination of factors including soaring energy and food prices, rising

interest rates and higher taxes. As a result, the OBR figures suggest

households are facing the largest fall in living standards on record.

Prior

to the Chancellor’s Statement, the latest gross domestic product figures from

the Office for National Statistics (ONS) had revealed that the UK economy

shrank in the three months to September. ONS said the economy contracted by

0.2% across the third quarter of the year driven by a decline in manufacturing

which was evident ‘across most industries.’

Survey

data also suggests the economy continued to shrink during the first two months

of the fourth quarter. The headline reading of S&P Global’s Purchasing

Managers’ Index, for instance,

sank to

a 21-month low of 48.2 in October and November’s preliminary reading rose only

marginally to 48.3. Any value under 50 represents economic contraction.

Last month, the Bank

of England (BoE) sanctioned a further increase in its benchmark interest rate

and said more rises were likely but not to levels that had been priced in by

financial markets.

At

a meeting which concluded on 2 November, the BoE’s nine-member Monetary Policy

Committee (MPC) voted to raise Bank Rate by 0.75 percentage points to 3.0%.

This was the eighth consecutive increase since December and the largest rate

hike since 1989. In addition, minutes to the meeting stated that a majority of

MPC members believe ‘further increases in

Bank Rate may be required for a sustainable return of inflation to target.’

However,

the minutes also pointed out that the peak in rates is expected to be lower

than markets had been anticipating. Indeed, in an unusually blunt message

delivered when announcing the rate decision, Bank Governor Andrew Bailey said,

“We can’t make promises about future

interest rates but based on where we stand today, we think Bank Rate will have

to go up by less than currently priced in financial markets.”

The

next interest rate announcement is due on 15 December and economists expect MPC members to sanction

another increase in rates – in a recent Reuters poll, more than three-quarters

of all economists surveyed predicted rates will rise by 0.5 percentage points,

with all of the other respondents predicting a 0.75 percentage point increase.

Comments

made during the last few weeks by a number of MPC members have also reaffirmed

the need for further rises in order to return inflation to the central bank’s

2% target. Some members, however, including BoE Deputy Governor Dave Ramsden,

have begun to mention the possibility of rate cuts at some point in the future,

should economic conditions diverge from current expectations and “persistence

in inflation stops being a concern.”

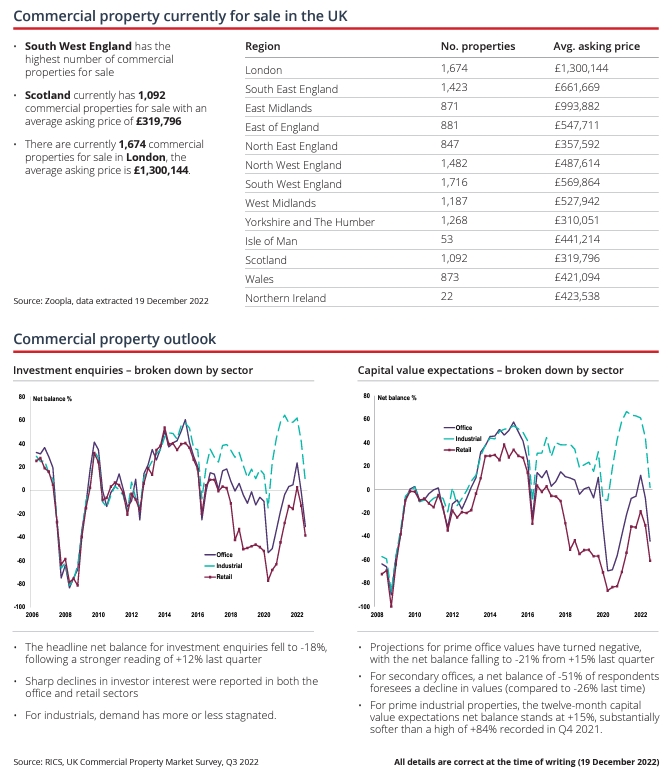

Markets (Data compiled by TOMD)

Global indices largely closed November in

positive territory. In the UK the FTSE 100 advanced, ending the month at its highest closing level

for five months, supported

by commodity and energy stocks. The blue-chip index closed the month up

6.74% to 7,573.05, while the mid-cap FTSE 250

gained 7.12% and the FTSE AIM ended

the month up 5.27%.

On Wall Street, markets closed sharply

higher following Federal Reserve Chair Jerome Powell’s speech on 30 November, indicating

the central bank might scale back the pace of its interest rate hikes as soon

as December. The Dow closed the month up 5.67% on 34,589.77, while the Nasdaq closed November on 11,468.00, up 4.37%.

At the end of

November, European Central Bank President Christine Lagarde said that a more

hawkish line on rising inflation was needed on the continent, suggesting that more

rate hikes are likely in the coming months. The Euro Stoxx 50 closed the month up 9.60%. In Japan, the

Nikkei 225 closed November up 1.38%.

On the foreign exchanges, the euro closed at €1.15 against

sterling. The US dollar closed the month at $1.19 against sterling and at $1.03

against the euro.

Brent

Crude closed the month trading at around $86 a barrel, a loss of 5.32%. Signs of an

oversupplied market earlier on in the month pushed prices lower but it

recovered in recent days as discussions on a Russian price cap continue and

government data showed US stockpiles plunging, while traders accelerated buying

amid optimism that China will soon loosen restrictions. Gold

is currently trading at around $1,753 a troy ounce, a gain of 6.99% on the month.

Record

pay growth still lags inflation

While the latest

earnings statistics revealed regular pay is now rising at a record level, the

data also showed wage growth is still failing to keep up with the rapidly

rising cost of living.

ONS

figures released last month showed average weekly earnings excluding bonuses

rose at an annual rate of 5.7% in the three months to September. This was the strongest recorded growth in regular pay

witnessed outside of the pandemic when the data was distorted by workers

returning from furlough.

However,

although the rate of pay growth is currently high by historic standards, wage

increases are still being outpaced by spiralling inflation – in real terms,

regular pay actually fell by 2.7% over the year to September. This represents a

slightly smaller decline than the record fall recorded three months ago but is

still among the largest falls since comparable records began in 2001.

The

latest official inflation statistics also revealed a further jump in price

growth during October, with soaring energy bills and food prices pushing the

annual figure to a 41-year high. The headline rate of Consumer Price Inflation

rose to 11.1% in the 12 months to October, a big jump from September’s rate of

10.1%.

Retail

sales rise in October

Official data shows

that retail sales staged a partial recovery in October although more recent

survey evidence suggests retailers remain relatively pessimistic about future

trading prospects.

The

latest ONS retail sales statistics revealed that total sales volumes rose by

0.6% in October, following a 1.5% decline during the previous month when shops

closed for the Queen’s funeral. Despite this partial rebound, ONS said the

broader picture was that sales are still on a downward trend that has been

evident since summer 2021 and that volumes remain below pre-pandemic levels.

Survey

evidence also highlights the current difficulties facing the retail sector,

with the latest Distributive Trades Survey from the CBI showing the net balance

of retailers reporting year-on-year sales growth falling from +18% in October to -19% in November. A similar proportion

also said they expect sales to fall this month suggesting most firms anticipate

little festive cheer this December.

Commenting on the findings, CBI Principal Economist Martin Sartorius said, “It’s not surprising that retailers are feeling the chill as the UK continues to be buffeted by economic headwinds. Sales volumes fell at a firm pace in the year to November, and retailers remain notably downbeat about their future business prospects.”

It

is important to take professional advice before making any decision relating to

your personal finances. Information within this document is based on our

current understanding and can be subject to change without notice and the accuracy

and completeness of the information cannot be guaranteed. It does not provide

individual tailored investment advice and is for guidance only. Some rules may

vary in different parts of the UK. We cannot assume legal liability for any

errors or omissions it might contain. Levels and bases of, and reliefs from,

taxation are those currently applying or proposed and are subject to change;

their value depends on the individual circumstances of the investor. No part of

this document may be reproduced in any manner without prior permission.