In mid-December, the Bank of England (BoE) announced another hike in its benchmark interest rate and warned that further increases are likely in order to sustainably return inflation to target level.

Following its latest meeting which concluded on 14 December, the BoE’s nine-member Monetary Policy Committee (MPC) voted by a 6-3 majority to raise Bank Rate by 0.5 percentage points to 3.5%. This was the ninth consecutive increase sanctioned by the MPC over the past 12-month period and took rates to their highest level since autumn 2008.

One member of the committee did vote for a more significant rise, preferring to increase Bank Rate by 0.75 percentage points in order to tackle what she viewed as heightened inflation risks since the previous meeting held in early November. The two other dissenting voices, however, each said it was now time to halt rate rises entirely, arguing that earlier policy decisions were “more than sufficient” to get inflation back to target.

While this difference in opinion does show that individual members of the committee are likely to hold differing views on the future path of interest rates, the minutes of the meeting did suggest further monetary tightening is likely. Specifically, they said, ‘The labour market remains tight and there has been evidence of inflationary pressures in domestic prices and wages that could indicate greater persistence and thus justifies a further forceful monetary policy response.’

In conclusion, the minutes stated, ‘The majority of the Committee judges that, should the economy evolve broadly in line with the November Monetary Policy Report projections, further increases in Bank Rate may be required for a sustainable return of inflation to target.’ The next MPC meeting is scheduled to take place early next month with the interest rate announcement due to be made on Thursday 2 February.

Jobs market shows signs of cooling

While the latest batch of labour market statistics suggest the jobs market may be starting to soften, they also show both vacancies and the number of people classed as economically inactive remain at historically high levels.

Figures released last month by the Office for National Statistics (ONS) revealed that the unemployment rate rose to 3.7% between August and October, up from 3.6% in the previous three-month period. The release also reported a drop in the number of job vacancies, which fell by 65,000 across the September–November period, the fifth consecutive decline for this measure.

Commenting on the data, ONS Head of Economic Statistics Sam Beckett suggested the fall in vacancies was a sign that the jobs market “could be starting to soften a little.” Ms Beckett went on to say that some businesses “were starting to pull some of their vacancies because they are reducing activity”,although she alsonoted that vacancies remain at historically high levels, with almost 1.2 million unfilled roles.

The latest release also reported a decline in the proportion of 16 to 64-year-olds who are neither in employment nor looking for work, with the economic inactivity rate falling to 21.5% between August and October, 0.2 percentage points lower than the previous three-month period. This reduction was most notable among older people, suggesting cost-of-living pressures may be prompting some to rethink early retirement plans.

Despite this fall, the inactivity rate remains significantly higher than before the pandemic, with over 560,000 more people now classed as economically inactive. As a result, employers continue to face recruitment challenges and, according to a report in The Times, this has led the government to consider plans to coax older people back into the workforce, with suggestions that a public information campaign focusing on the over-50s could air in the spring.

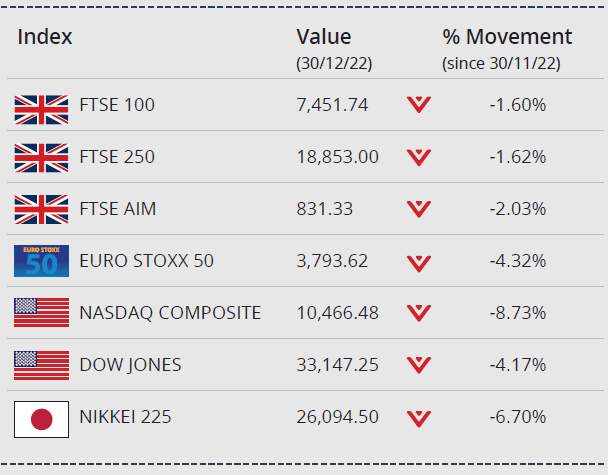

Markets (Data compiled by TOMD)

Major global indices closed December in negative territory, rounding off a challenging year, impacted by the war in Ukraine, rising inflation, higher interest rates and recessionary concerns.

The UK’s benchmark index ended the year slightly higher in contrast to the sharp drop in other domestic, US and European markets. The blue-chip FTSE 100 index lost 0.81% on the last trading day of the year, to close at 7,451.74, a modest gain of 0.91% for 2022 as a whole. The domestically focused FTSE 250, more closely correlated to the UK economy, weighed down by economic and political uncertainty, closed the year 19.70% lower on 18,853.00, while the FTSE AIM closed on 831.33, a loss of over 31% in the year.

In the US, the Dow closed the year registering its biggest annual loss since the 2008 financial crisis. The Federal Reserves’ quickest succession of rate hikes in forty years taking their toll on markets. The Dow closed the year down around 8.78% on 33,147.25, while the NASDAQ closed the year down over 33% on 10,466.48. Meanwhile, the Nikkei 225 ended the year on 26,094.50, down over 9%, and the Euro Stoxx 50 closed the year over 11% lower on 3,793.62.

On the foreign exchanges, the euro closed the year at €1.12 against sterling. The US dollar closed the year at $1.20 against sterling and at $1.07 against the euro.

Brent crude closed the year trading at around $84 a barrel, an annual gain of over 8%. At the end of December, oil prices were negatively impacted as the US and UK became the latest countries to impose restrictions on travellers from China amid fears over surging COVID infection numbers. In addition, fears of recessions around the world look set to impact oil demand and prices into 2023. Gold is trading at around $1,813 a troy ounce, a small annual loss of around 0.43%.

UK economy rebounds in October

Although official growth statistics released last month did reveal an expansion in output during October, survey evidence still suggests the UK economy is likely to have already entered recession.

According to the latest gross domestic product figures the economy grew by 0.5% in October compared to the previous month. This rebound, however, came after September’s output was negatively impacted by the additional bank holiday for Queen Elizabeth’s funeral, which resulted in reduced trading hours for many businesses.

Despite October’s bounce-back, most analysts still expect the economy to have contracted during the fourth quarter as a whole. With third quarter data revisions showing the economy shrank by 0.3% in the three months to September, if output does fall across the final quarter of the year, it will be a second successive quarterly contraction and thereby meet the technical definition of a recession.

Survey data does suggest the economy is likely to have shrunk during the final two months of the year. The headline reading of S&P Global’s Purchasing Managers’ Index, for instance, came in at 48.2 in November while December’s preliminary reading was 49.0; any value below 50 represents economic contraction with these figures pointing to a fourth quarter decline of 0.3%.

Inflation rate eases slightly

Official consumer price statistics show the UK headline rate of inflation dipped in November although the latest figure does remain more than five times above the BoE’s 2% target level.

Data released last month by ONS revealed that the Consumer Prices Index (CPI) 12-month rate – which compares prices in the current month with the same period a year earlier – stood at 10.7% in November. This was down from the previous month’s figure of 11.1% and represents a sharper fall than had been predicted in a Reuters poll of economists.

ONS said the largest downward contributions came from motor fuels, with prices easing from previous record highs, and second-hand cars. These dips, however, were partially offset by a further rise in price levels at restaurants, cafes and pubs, as well as continuing growth in food prices which increased by a 45-year high of 16.5%.

While the latest data shows the cost of living is still rising at its fastest pace in 40 years, it has raised hopes that the surge in prices may now have peaked. Although analysts expect inflation to remain at relatively elevated levels, November’s dip is forecast to be followed by further declines over the coming months.

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.