| Bank Rate cut to 4% (lowest in over two years) but mortgage rates remain stable | UK house price growth forecast has been lowered to 1% in 2025 as high supply prompts more competitive pricing | Homes gained 20% in value since 2020, with northern regions leading growth while parts of London face declines |

Another reduction to Bank Rate

In its August meeting, the Bank of England (BoE) voted to reduce Bank Rate from 4.25% to 4%. This is the fifth cut since August 2024 and the lowest level in over two years.

The decision may have come as a surprise to some, as inflation rose to 3.6% in June and 3.8% in July according to the Office for National Statistics. The BoE expects inflation will increase to around 4% in September (double its target of 2%) but believes that the spike will be temporary.

The reduction in Bank Rate may present opportunities for borrowers on tracker mortgages and those with fixed deals that are coming to an end. However, mortgage rates might not see a significant change. Richard Donnell at Zoopla explained, “The price of fixed rate mortgages already factors in the future path of base rates meaning average mortgage rates are likely to remain broadly where they are today.”

Housing market update

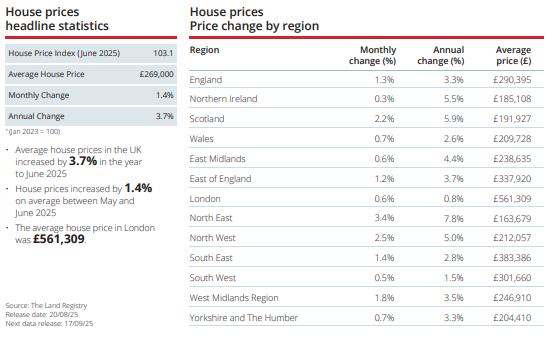

The housing market has had some setbacks this year, but buyer activity is slowly improving.

Savills has revised its forecast for UK house price growth in 2025 from 4% to 1%, following a ‘cautious start to the year and the potential for more buyer jitters in the run up to the Autumn Budget given the state of public finances.’

Housing supply currently remains high, as buyers have the most choice in over 10 years, according to Rightmove. This has prompted sellers to rethink their pricing, with TwentyCi reporting 21% more price adjustments between May and July than the same period last year. As a result of this competitive pricing, sales agreed are up 8% annually according to Zoopla. It will take some time before this improved activity has a knock-on effect on house price growth due to stock being high.

UK homes gain 20% in 5 years

Research from Zoopla has found that the average home has increased in value by 20% since the pandemic, amounting to an average gain of £55,800.

One million homes have increased by 50% or more, gaining £117,400 on average. More than half of these properties can be found in the North West, Wales, and Yorkshire and the Humber. These areas have become more popular among buyers in recent years as they offer more affordable options and are suited to lifestyle changes made since the pandemic.

In more expensive regions, including the south of England, the growth is more modest – half (51%) of properties have increased in value by 20%. Meanwhile, London has experienced difficulties, with 13% of homes dropping in value by 5% or more. Kensington and Chelsea, and Westminster have been the hardest hit, as nearly half of properties in these boroughs are now below their pre-pandemic price.

How’s the Scottish housing market faring?

Data from Registers of Scotland shows that residential transactions increased by 7% annually in Q1 2025, the fourth consecutive quarter of growth.

The rise contributed to higher Land and Buildings Transaction Tax revenue, which the Scottish Government estimated to be £484.7m in 2024/25, up 14.8% on the previous tax year.

According to UK Finance, in 2024/25 the number of mortgages advanced to Scottish first-time buyers (FTBs) increased by 17.0% year-on-year. In Q1, the average loan-to-value ratio was 82.4% for FTBs and 69.6% for home movers.

As for the rental market, data from letting agents shows that there has been a decline in new-let private rental growth in recent years. The annual growth rate recorded in Citylets Rental Index was 4.4% in Q1 2025, significantly lower than the peak of 13.7% in Q3 2023.

All details are correct at the time of writing (20 August 2025)

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission