Rate-hike pause as inflation dips

Last month, the Bank of England announced a pause in its long run of interest rate rises following an unexpected dip in the UK headline rate of inflation and ‘increasing signs’ that higher rates were starting to hurt the real economy.

Following its latest meeting, which concluded on 20 September, the BoE’s Monetary Policy Committee (MPC) voted by a narrow margin to leave Bank Rate unchanged at 5.25%. This was the first occasion since December 2021 that an MPC meeting had not resulted in the Bank’s benchmark rate of interest being raised.

The decision was clearly a very close call with four of the nine-member committee voting to increase rates by a further 0.25 percentage points. The minutes to the meeting also reiterated that the MPC would be prepared to raise rates again if there was ‘evidence of more persistent inflationary pressures.’ They also repeated previous guidance that monetary policy would remain ‘sufficiently restrictive for sufficiently long’ to return inflation back to its target level.

Commenting on the day the decision was announced, BoE Governor Andrew Bailey said, “Inflation has fallen a lot in recent months and we think it will continue to do so.” The Governor did, however, warn against “complacency” and “premature celebration” and added, “We need to be sure inflation returns to normal and we will continue to take the decisions necessary to do just that.”

Data published by the Office for National Statistics (ONS) the day before the MPC’s announcement had revealed a surprise fall in inflation. The Consumer Prices Index (CPI) 12-month rate – which compares prices in the current month with the same period a year earlier – fell to 6.7% in August, down from 6.8% in July. Most economists had predicted a slight uptick in August’s CPI rate primarily due to a rise in global fuel prices.

UK economy contracts in July

Gross domestic product (GDP) figures released last month showed the UK economy shrank by a greater than expected amount in July, while forward-looking indicators suggest a recession looks ‘increasingly likely.’

The latest monthly GDP statistics produced by ONS revealed that the economy shrank by 0.5% in July. This figure was worse than all forecasts submitted to a Reuters poll of economists with the consensus prediction suggesting the economy would suffer a 0.2% contraction.

ONS said July’s weak figure partly stemmed from a reduction in output within the services sector, with this drop driven by the impact of industrial action by NHS workers and teachers. In addition, heavy rainfall across the month also hit activity in both the construction and retail industries.

The UK economy has so far avoided recession this year with positive growth numbers recorded across both the first and second quarters. New data released at the end of September confirmed that the UK’s economy grew 0.2% in Q2.

The preliminary headline reading from the S&P Global/CIPS UK Purchasing Managers’ Index (PMI) fell from 48.6 in August to 46.8 in September. This represents the sharpest fall in output since January 2021 and, excluding pandemic lockdown months, the steepest decline since the height of the global financial crisis in March 2009.

Commenting on the findings, S&P Global Market Intelligence’s Chief Business Economist Chris Williamson said, “The steep fall in output signalled by the flash PMI data is consistent with GDP contracting at a quarterly rate of over 0.4%, with a broad-based downturn gathering momentum to hint at few hopes of any imminent improvement.”

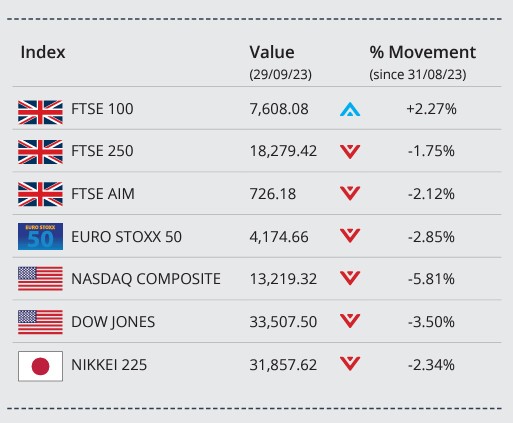

Markets (Data compiled by TOMD)

As September drew to a close, many major global stock markets ended the month in negative territory. During the final trading days of Q3, some European markets were boosted as data indicated the UK’s economy grew in Q2 and inflation across the eurozone is cooling.

In the US, the latest consumer confidence and home sales reports fuelled economic concerns and weighed on markets. The Dow Jones Index closed the month down 3.50% on 33,507.50, while the tech-orientated NASDAQ closed the month down 5.81% on 13,219.32.

In the UK, the FTSE 100 closed the month on 7,608.08, a gain of 2.27%, while the mid cap focused FTSE 250 closed down 1.75% on 18,279.42. The FTSE AIM closed September on 726.18, a loss during the month of 2.12%. On the continent, the Euro Stoxx 50 closed on 4,174.66, a loss of 2.85%.

In Asia, ongoing weakness in China’s property sector continues to weigh on the region. The Japanese Nikkei 225 closed the month on 31,857.62 down 2.34%.

On the foreign exchanges, the euro closed the month at €1.15 against sterling. The US dollar closed at $1.21 against sterling and at $1.05 against the euro.

Brent crude closed September trading at around $92, a gain over the month of 6.89%. Russia’s announcement of a temporary ban on gasoline and diesel exports to most countries is bringing uncertainty into the market. Gold closed the month trading at around $1,870 a troy ounce, a monthly loss of around 3.70%.

Retail sector shows signs of recovery

The latest official retail sales statistics revealed a partial rebound in sales volumes during August while more recent survey evidence highlights ‘elements of optimism’ within the retail sector.

According to ONS data published last month, total retail sales volumes rose by 0.4% in August. This growth in the quantity of goods bought by consumers follows July’s 1.1% fall when sales were impacted by an unseasonal spell of wet weather which upset normal summer spending patterns. ONS noted that August’s partial recovery was driven by increased food sales and a strong month for clothing.

Recently-released survey data from GfK also shows consumers remain remarkably resilient with sentiment at its highest level since the start of 2022 as households become increasingly hopeful about the economy. The latest CBI Distributive Trades Survey also suggests the retail sector expects to see modest sales improvements in the coming months with one gauge of retailers’ expectations hitting a three-month high.

Commenting on the findings, CBI Principal Economist Martin Sartorius said, “There are some elements of optimism in our survey. Lower than expected inflation figures, which in turn will ease pressure on household budgets, will also give retailers some hope going into the crucial autumn and winter trading period.”

Chancellor downplays tax-cut hopes

Analysts have warned that the latest public sector finance statistics leave the Chancellor with little room to offer tax cuts when he delivers his Autumn Statement next month.

ONS data recently revealed that government borrowing totalled £11.6bn in August, the fourth highest amount ever recorded for that month. The figure was also £3.5bn more than the government borrowed in the same month last year and was slightly ahead of analysts’ expectations.

While inclusion of the latest data does still leave the fiscal year-to-date deficit comfortably below the most recent forecast published by the Office for Budget Responsibility (OBR), analysts typically believe there remains little scope for potential tax cuts in the near future. This reflects the expected economic slowdown, which is likely to hit tax revenues, as well as anticipated upward revisions to OBR projections due to higher debt interest costs.

Chancellor Jeremy Hunt also recently acknowledged that rising debt interest payments caused by higher long-term interest rates were putting increased pressure on the public finances. He also admitted it would be “virtually impossible” to include tax cuts in his upcoming fiscal update. Earlier in the month, Mr Hunt announced he will deliver this year’s Autumn Statement on 22 November.

All details are correct at the time of writing (02 October 2023 )

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.