Inflation rate holds steady

The Bank of England (BoE) Governor has described the latest batch of inflation statistics as “quite encouraging,” adding that he expects a “noticeable drop” in the headline rate when the next set of data is released later this month.

Figures recently published by the Office for National Statistics (ONS) revealed that the Consumer Prices Index (CPI) 12-month rate – which compares prices in the current month with the same period a year earlier – held steady at 6.7% in September. This ended a run of three consecutive monthly declines and came in slightly ahead of analysts expectations’ of a further 0.1% fall.

ONS pointed out that the figures did include the first monthly decline in food price levels for two years. However, a sharp rise in fuel costs between August and September was the main factor that prevented the CPI annual rate from declining again. Despite remaining unchanged, though, September’s update does leave CPI below the level forecast by the BoE in early August.

The latest release did also report a fall in core inflation, which excludes volatile elements such as energy, food, alcohol and tobacco, although this decrease was again less than economists had predicted. This measure of inflation, which is typically viewed as a better guide to longer-term price trends, fell to 6.1% in September from 6.2% in August.

Commenting on the consumer prices data release in an interview with the Belfast Telegraph, BoE Governor Andrew Bailey said, “It was not far off what we were expecting. Core inflation fell slightly from what we were expecting and that’s quite encouraging.” The Governor also stressed that he expects to see a “noticeable drop” in the CPI rate when the next set of figures are published in mid-November as last year’s sharp hike in energy prices drops out of the annual comparison.

Economy stages partial rebound

Growth statistics released last month by ONS showed the UK economy returned to growth in August following a sharp decline in July, although forward-looking indicators continue to suggest the outlook remains uncertain.

According to the latest gross domestic product (GDP) figures, the UK economy grew by 0.2% in August following a downwardly revised fall of 0.6% in July. ONS said August’s modest bounce back was partly driven by the education sector, which recovered from two days of industrial action the previous month, along with a boost from computer programmers and engineers.

While analysts typically described the latest GDP data as ‘lacklustre,’ August’s figures are thought to have reduced the possibility of a recession beginning as early as the July to September period. Indeed, ONS noted that the economy would only need to have grown by 0.2% during September to avoid it contracting across the third quarter as a whole.

Data from the latest S&P Global/CIPS UK Purchasing Managers’ Index released towards the end of last month, however, does suggest that business activity across the private sector continues to weaken. The preliminary composite headline Index stood at 48.6 in October, a marginal increase from September’s figure of 48.5, but below the 50 threshold that denotes a contraction in private sector output for the third month running.

Commenting on the survey’s findings, S&P Global Market Intelligence’s Chief Business Economist Chris Williamson said, “The UK economy continued to skirt with recession in October, as the increased cost of living, higher interest rates and falling exports were widely blamed on a third month of falling output. The overall pace of decline remains only modest, but gloom about the outlook has intensified in the uncertain economic climate, boding ill for output in the coming months. A recession, albeit only mild at present, cannot be ruled out.”

Markets (Data compiled by TOMD)

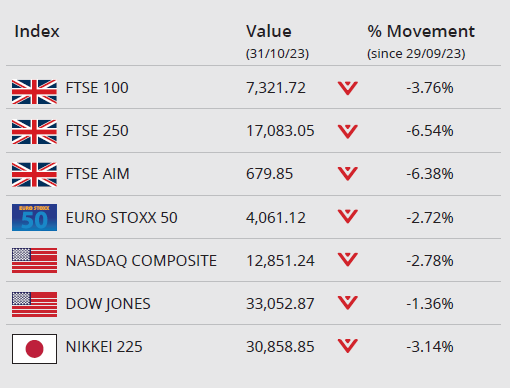

As October drew to a close, investors focused on major central bank meetings with the Bank of England and Federal Reserve due to meet in early November.

In the UK, the FTSE 100 closed October on 7,321.72, a loss of 3.76%. At month end losses in some mining and energy stocks weighed, impacted by declines in commodity prices following weaker-than-expected factory activity data in China. The domestically-focused FTSE 250 closed down 6.54% on 17,083.05, while the FTSE AIM closed the month on 679.85, a loss of 6.38%. On the continent, the Euro Stoxx 50 ended October on 4,061.12, a loss of 2.72%.

At month end, Asian equities struggled as disappointing activity data from China reignited some concerns over the resilience of the world’s second largest economy. In Japan the Nikkei 225 closed the month on 30,858.85, down 3.14%.

A raft of new data has highlighted resilience in the US economy. Comments from Federal Reserve Chairman Jerome Powell will be closely watched as an indicator of how long interest rates are likely to remain elevated. The Dow Jones Index closed the month down 1.36% on 33,052.87, while the NASDAQ closed the month down 2.78% on 12,851.24.

On the foreign exchanges, the euro closed the month at €1.14 against sterling. The US dollar closed at $1.21 against sterling and at $1.05 against the euro.

Safe haven demand as a result of the Middle Eastern conflict saw gold prices trading higher in the month. Gold closed October trading at around $1,996 a troy ounce, a monthly gain of around 6.76%. With traders wary of any new developments in the conflict and concerns over slowing fuel demand in China weighing, Brent crude closed the month trading at around $85, a loss over the month of 7.41%.

Jobs market continues to cool

Last month’s release of labour market statistics suggests there has been a further softening in the UK jobs market, although earnings data did reveal average pay is now rising above inflation for the first time in almost two years.

The latest figures released by ONS were dubbed ‘experimental estimates’ produced under a new calculation that attempts to account for low response rates to the labour force survey. The new data showed that, although the unemployment rate stayed unchanged at 4.2% during the June to August period, the overall level of employment fell and the rate of economic inactivity rose.

In addition, the estimated total number of job vacancies dropped by 43,000 during the three months to September, the 15th consecutive reported decline. This reduced the number of vacancies to a two-year low of 988,000, although this figure is still significantly above pre-pandemic vacancy levels recorded in early 2020.

The latest earnings figures also revealed that regular pay rose at an annual rate of 7.8% in the June to August period, higher than the average inflation rate over the same three months. Furthermore, data revisions meant that wage growth actually outpaced inflation in the three months to July for the first time since October 2021.

Retail sales in autumnal fall

Official retail sales statistics reported a sharper than expected decline in sales volumes during September, while more recent survey evidence suggests the current trading environment remains extremely challenging.

Data published last month by ONS revealed that total retail sales volumes fell by 0.9% in September, a much larger decline than the 0.2% fall predicted in a Reuters poll of economists. ONS said it had been ‘a poor month for clothing stores’ with the unseasonable warm autumnal conditions reducing sales of colder weather gear, while the quick pace of price rises had deterred shoppers from buying ‘non-essential goods.’

The latest CBI Distributive Trades Survey suggests sales remained weak last month, with retailers reporting the joint-worst level of sales volumes for October since records began in 1983. The survey also found that retailers do not anticipate a turnaround in fortunes this month, with cost-of-living concerns and higher interest rates expected to continue weighing on consumer spending.

Commenting on the findings, CBI Principal Economist Martin Sartorius said, “As the festive period approaches, the retail sector remains in a perilous position. While slowing inflation should help to bolster households’ income in the coming months, retailers will continue to face headwinds from higher energy and borrowing costs.”

All details are correct at the time of writing (01 November 2023 )

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.