| According to Rightmove, demand In Q4 2024 for industrial listings was 72% higher than in Q4 2023 | The market in Scotland in Q4 was strong with industrial (+41%), office (+12%) and retail (+6%) | The RICS long-term outlook remains positive for the commercial property sector |

Industrial prowess helps commercial demand soar

Demand for investment in commercial property has soared following recent cuts to Bank Rate, according to Rightmove’s Quarterly Commercial Insights Tracker.

The continued recovery for the investment sector comes amid falling interest rates, which make opportunities more affordable.

The industrial sector led the way, with record demand recorded. Specifically, demand for industrial listings was +72% higher than in Q4 2023, while demand within the industrial sector for leasing was +31% against the same measure.

Likewise, the office sector (+57%) has seen the biggest jump in investment demand compared to the same period the previous year. Demand to lease office space is +11% higher than the same three-month period a year ago, as the UK workforce continues the recent trend of spending more time in the office.

Strong Scottish demand for commercial property

Scotland’s commercial property market continued its purple patch in Q4 2024, according to the latest Royal Institution of Chartered Surveyors (RICS) Commercial Property Monitor, which revealed increased demand from both investors and occupiers.

Within the sub-sectors, industrial (+41%), office (+12%) and retail (+6%) space all saw increased investor demand in Scotland. Notably, this was the first time since 2015 that investor demand for retail space had grown.

On the occupier demand side, a net balance of 10% of surveyors in Scotland reported a rise, significantly higher than in the previous quarter. All sub-sectors saw occupier demand jump: industrial space (+18%) prospered, ahead of office (+11%) and retail (+3%).

Moreover, enhanced activity in Scottish commercial property looks set to extend further into 2025: a net balance of 13% of respondents in Scotland anticipate a rise in rental values over the next quarter.

Prime office rents keep overall demand steady

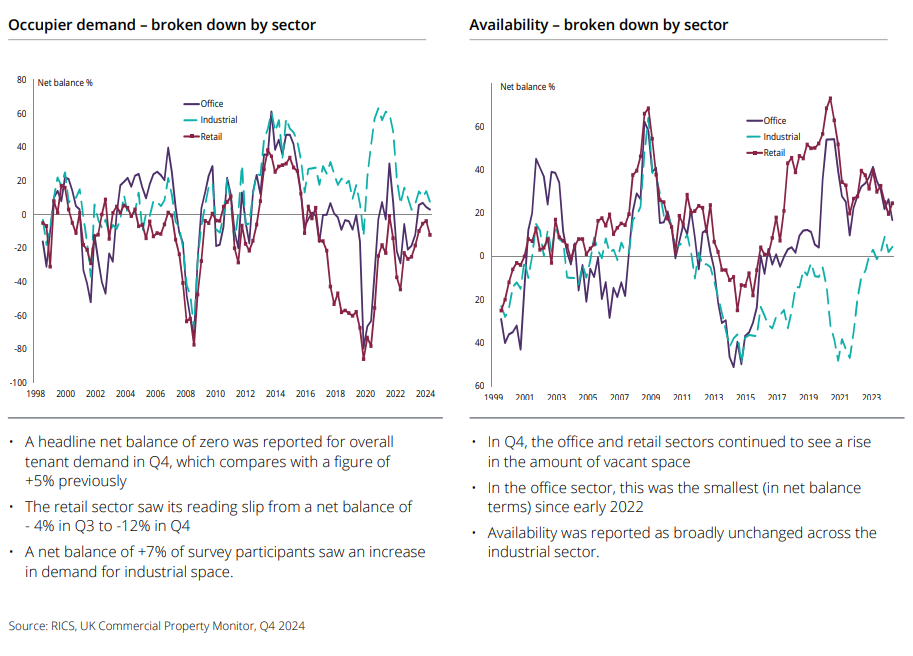

The UK’s commercial property market faltered a little in Q4 2024, figures released by RICS seemed to indicate, even as demand for high-quality sustainable offices remained strong.

Tenant demand remained steady overall in the final quarter of 2024, with a net balance of zero, data revealed. Retail property recorded negative figures but industrial (+7%) and office (+3%) demand made up for the shortfall.

Despite a few bumps in the road, the long-term outlook remains positive, the RICS data suggested. With a resilient and competitive prime office sector and strong demand for industrial property, analysts remain confident in the overall direction of travel being positive for the foreseeable future. Notably, demand for prime, quality space continues to rise, with prime office rents (+40%) one of the strongest performers in the latest quarter.

Green light for new Bishopsgate skyscraper

The City of London Corporation has given the go-ahead to a 54-storey skyscraper next to London Liverpool Street Station that will provide 1.2 million square metres of office space by 2040.

The newly approved development at 99 Bishopsgate will be one of the tallest buildings in the Square Mile. As companies continue their attempts to lure employees back to their desks, analysts are signalling strong appetite for well-connected top-tier buildings in London.

Other upcoming projects in the capital include the 74-storey One Undershaft, the 63-storey 55 Bishopsgate, and the 36-storey 60 Gracechurch Street. The City’s current tallest office building, 22 Bishopsgate, reached full occupancy in January.

All details are correct at the time of writing (19 February 2025)