Growth stronger than expected in late 2024

Data released last month by the Office for National Statistics (ONS) revealed that the UK economy unexpectedly grew in the final three months of last year, although more recent survey evidence still points to a sluggish outlook.

The latest gross domestic product (GDP) statistics showed that economic output rose by 0.1% in the fourth quarter of 2024, after flatlining across the previous three-month period. While the figure still only represents a relatively lacklustre rate of expansion, it was significantly stronger than economists had been expecting, with the consensus forecast in a Reuters poll predicting a 0.1% contraction during the final three months of the year.

A monthly breakdown showed that the final quarter GDP figure was lifted by a strong performance in December, which saw a 0.4% expansion. This reflected robust service sector growth, with ONS noting that wholesalers, film distributors, pubs and bars all did particularly well, while machinery manufacturers and pharmaceutical companies performed strongly too. In addition, however, it was noted that December’s growth relied on government spending and a potentially temporary build-up in firms’ inventories.

Data from a recently released economic survey also suggests growth in the first two months of 2025 has been tepid. February’s flash headline growth indicator from the S&P Global/CIPS UK Purchasing Managers’ Index (PMI) dipped to 50.5 from 50.6 in January, leaving the index only marginally above the 50.0 no change threshold, implying the UK economy has seen little growth so far this year.

S&P Global Market Intelligence’s Chief Business Economist Chris Williamson said, “Early PMI survey data for February indicate that business activity remained largely stalled. While marginal output growth was eked out in February, order books deteriorated at a rate not seen since August 2023 to hint at likely cuts to business activity in the coming months unless demand revives.”

Interest rates cut; inflation jumps

Last month, the Bank of England (BoE) sanctioned a further cut in interest rates but said it would be ‘careful’ about future reductions in the face of an expected spike in inflation and global uncertainty.

Following its latest meeting, which concluded on 5 February, the BoE’s nine-member Monetary Policy Committee (MPC) voted by a 7-2 majority to reduce rates by 0.25 percentage points, taking Bank Rate down to 4.5%. The two dissenting voices both voted for a larger cut of 0.5 percentage points.

Alongside the rate announcement, the Bank unveiled its latest economic projections, which included a halving of its 2025 growth forecast to 0.75%. The updated outlook also predicts inflation will rise to nearly double the Bank’s 2% target level, peaking at 3.7% in the third quarter of this year and not return to target until the end of 2027.

Commenting after announcing the MPC’s decision, BoE Governor Andrew Bailey reaffirmed his expectation that rates would continue on a downward trajectory, but added “We will have to judge meeting by meeting, how far and how fast.” Mr Bailey also stressed the need to remain “gradual and careful” when reducing rates further because “we live in an uncertain world and the road ahead will have bumps on it.”

This bumpy road was vividly highlighted two weeks later when the official inflation statistics were published, with the annual headline rate jumping to 3.0% in January from 2.5% in December. ONS said this higher-than-expected increase was driven by rising food prices, a smaller-than-usual drop in air fares and an increase in private school fees.

January’s data leaves inflation at a 10-month high with analysts predicting further rises to come. April in particular is likely to see a notable jump, with energy, water and council tax bills all set to rise during that month.

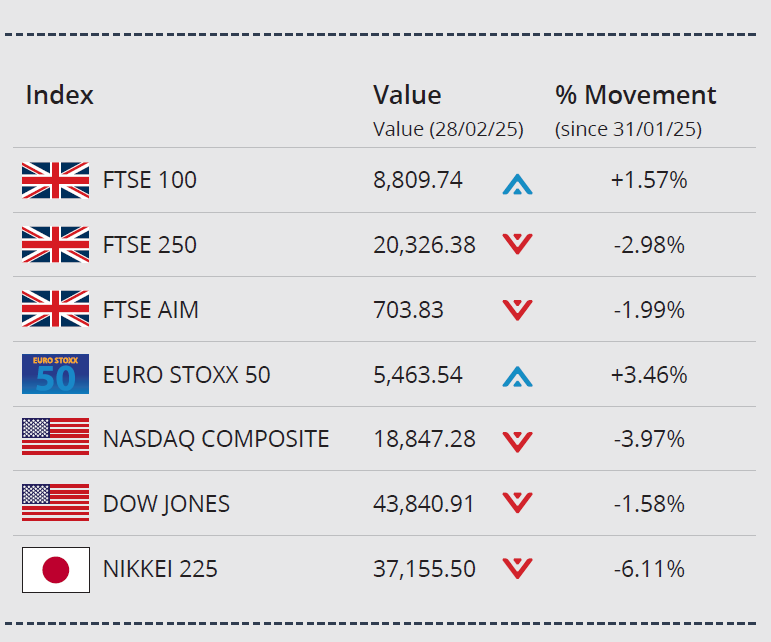

At the end of February, global markets remained under pressure as investors reacted to economic uncertainty, with Trump’s trade policies continuing to weigh on sentiment.

US stocks fell after the Trump-Zelensky Oval Office exchange on Friday 28 February, before moving higher in the afternoon session. The Dow closed February 1.58% lower on 43,840.91, while the tech-orientated NASDAQ closed February down 3.97% on 18,847.28.

In the UK, the internationally focused blue-chip FTSE 100 index closed the month on 8,809.74, a gain of 1.57%. At month end the index rose as hopes increased of a potential trade deal between the UK and the US, following a week of crunch talks in Washington. The mid-cap focused FTSE 250 closed February down 2.98% on 20,326.38, while the FTSE AIM closed on 703.83, a loss of 1.99%.

On the continent, the Euro Stoxx 50 closed February 3.46% higher on 5,463.54. In Japan, the Nikkei 225 ended February on 37,155.50, a monthly loss of 6.11%.

On the foreign exchanges, the euro closed the month at €1.21 against sterling. The US dollar closed at $1.25 against sterling and at $1.03 against the euro.

Gold closed February trading around $2,863 a troy ounce, a small monthly gain of 0.44%. At month end, the gold price fell as concerns escalated over Trump’s sweeping tariff strategy and a stronger dollar put pressure on the precious metal. Brent Crude closed the month trading at around $69.91 a barrel, a monthly loss of just over 4.0%, as concerns about the risks posed by tariffs to the global economy and demand for fuel weigh on sentiment.

Pay growth accelerates; vacancies still falling

The latest batch of labour market statistics showed that UK wage growth remained strong in late 2024, while surveys suggest companies are planning to cut jobs or recruit fewer people over the coming months.

Figures published by ONS last month showed that average weekly earnings excluding bonuses rose at an annual rate of 5.9% across the final quarter of last year. This figure was up from 5.6% in the previous three-month period and represents the strongest reading since the three months to April 2024.

The data release also revealed yet another decline in the overall number of job vacancies. In total, ONS said there were 9,000 fewer vacancies reported between November and January 2025, the 31st consecutive monthly fall. And survey evidence suggests this decline is likely to continue as firms look to cut headcounts and freeze hiring as a result of higher employment costs associated with changes announced in the Autumn Budget.

A Chartered Institute of Personnel and Development survey released last month, for instance, found that around one in three firms are planning to reduce their headcount through redundancies or by recruiting fewer workers ahead of April’s National Insurance contributions hike and the uplift in the minimum wage.

Retail sales grew strongly in January

Official retail sales statistics released last month showed that sales volumes rebounded sharply in the first month of this year, while survey evidence points to a modest pick-up in consumer sentiment during February.

According to the latest ONS data, retail sales volumes rose by 1.7% in January, a strong bounce back from December’s 0.6% decline. The figure was also higher than all estimates submitted to a Reuters poll of economists which had pointed to growth of just 0.3%. ONS did, however, note that the increase was largely due to strong food sales, with other sectors, such as clothing and household goods, recording a more ‘lacklustre’ performance.

Encouragingly for the retail sector, data from GfK’s most recent consumer confidence index also reported a modest improvement in consumer sentiment. Overall, February’s headline confidence figure rose to -20 from -22 the previous month, with all five of the survey’s components improving, led by a four-point gain in personal finance expectations.

Evidence from the latest CBI Distributive Trades Survey, though, found that retailers remain ‘downbeat’ about their future business situation, with the data pointing to a sharp sales downturn in March, partly due to the later timing of Easter compared to last year.

All details are correct at the time of writing (03 March 2025)

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from, taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.