“The economy shrank a little in January but grew in the latest three months as a whole”

The UK economy shrank unexpectedly in January, according to official data released on Friday by the Office for National Statistics (ONS). With a contraction of 0.1%, the economy fared worse at the start of 2025 than analysts had predicted, with the figure seen as a blow to the government ahead of its Spring Forecast later this month.

Weaker economic performance followed a promising end to 2024, with growth of 0.4% recorded in December. The fall was driven mainly by a decline in the manufacturing sector, while oil and gas extraction and construction also had weak months. At the other end of the spectrum, services including retail recorded positive growth in January.

Ben Jones, Lead Economist at the Confederation of British Industry, commented, “After a surprisingly strong performance in December, some pay-back was always a possibility in January. But the mixed picture across different sectors in recent months suggests the recovery is still fragile.”

Boosting growth remains the government’s key priority and the negative data could complicate Chancellor Rachel Reeves’ plans on tax and spending, analysts noted. Responding to the latest growth figures, Reeves said, “The world has changed and across the globe we are feeling the consequences.”

Liz McKeown, ONS Director of Economic Statistics, added, “The economy shrank a little in January but grew in the latest three months as a whole, with the overall picture continuing to be of weak growth.”

Stamp Duty deadline dampens housing market

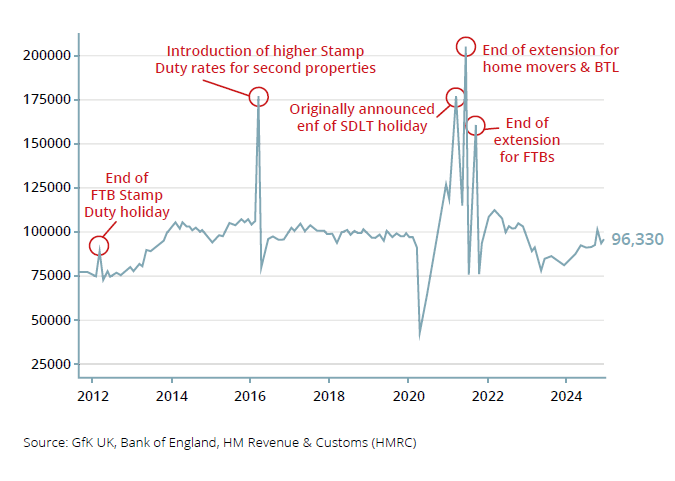

The looming Stamp Duty Land Tax (SDLT) deadline could be stalling momentum in the housing market, according to the latest UK Residential Property Survey released last week by the Royal Institution of Chartered Surveyors (RICS).

Buyer demand fell to a net balance of -14% in February, down from -1% in January, making this the lowest such reading since November 2023. Meanwhile, house prices continued to rise (+11%) but at a ‘subdued’ rate, the report noted, though most respondents still expressed the belief that prices would increase in the next 12 months.

Simon Rubinson, RICS Chief Economist, commented, “The UK housing market appears to be losing some momentum as the expiry of the temporary increase in Stamp Duty thresholds approaches.”

Side hustlers get tax allowance boost

Some 90,000 people who work a ‘side hustle’ might soon be exempt from filing a tax return or paying any tax on their side earnings, Exchequer Secretary to the Treasury, James Murray, announced last week.

The reporting threshold for trading income is likely to be increased from £1,000 to £3,000, a move that will see many people who earn extra fall under the limit. The government claims the move will ‘free up time for taxpayers helping to create the conditions for economic growth,’ but is yet to announce the exact date that the rule change will come into effect.

Card spending slows but confidence rises

UK consumer card spending grew by only 1.0% year-on-year in February, according to the Barclays Consumer Spend report released last week, a sizeable fall from January’s 1.9% increase and well below inflation. At the same time, however, confidence in personal finances soared to its highest level since the survey question began in 2015.

In total, some 75% of consumers say they feel optimistic about their household budgets. Indeed, although essential spending fell in February, discretionary spending proved resilient with 2.1% growth, and spending in the retail sector grew, notably for electronics. Meanwhile, two in five consumers say they found ways to save money.

Mortgage lending grows in Q4 2024

Mortgage lending grew substantially in Q4 2024, the Bank of England’s Mortgage Lenders and Administrators Return has revealed, with the outstanding value of residential mortgage loans increasing by 0.5% to £1,678bn.

As well as rising to the highest total amount since reporting began in 2007, the proportion of lending to high loan-to-income borrowers increased to reach a total of 45.8%. The release also revealed that first-time buyers now make up a market share of 29.6%, the highest since 2007.

Stricter tests for Personal Independence Payments (PIPs)

On Tuesday, Work and Pensions Secretary Liz Kendall announced changes to the welfare system aimed at saving £5bn by the end of 2030. She confirmed that payments will go up in line with inflation this year, but the eligibility criteria will be tightened up from November 2026. There will also be a review of the Pip assessment process.

Financial advice is key, so please do not hesitate to get in contact with any questions or concerns you may have.

The value of investments can go down as well as up and you may not get back the full amount you invested. The past is not a guide to future performance and past performance may not necessarily be repeated.

All details are correct at time of writing (19 March 2025)