| May 2025 saw the busiest agreed home sales since 2022, led by post-Stamp Duty change recovery | Prime Central London prices fall 2.2% annually as tax changes hit international demand | Government pledges £39bn over 10 years for affordable housing in largest investment in 50 years. |

May sales hit post-2022 high as housing market regains momentum

Rightmove says May 2025 was the busiest month for agreed sales since March 2022.

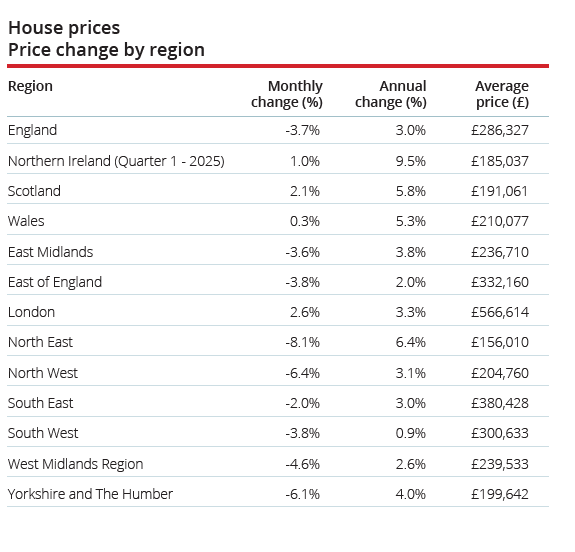

The rush to complete before April’s Stamp Duty changes caused a spike in March, followed by a 4% dip in buyer demand and the slowest annual May price growth since 2016. Despite this pause, home-movers have quickly returned. Sales agreed were up 6% year-on-year across Great Britain, with Wales leading at +15% and London showing more modest growth at +1%. May’s figures also mark the most active May since 2021, suggesting growing confidence among buyers and sellers adjusting to the new tax and borrowing landscape.

Rightmove’s earlier data pointed to a more stable market with the post-deadline adjustment period giving way to renewed momentum. Buyers appear more willing to press ahead, even with higher costs, suggesting resilient housing demand across much of the country.

Price cuts return in Prime Central London as demand softens

Sellers in Prime Central London are reducing prices to tempt buyers, following tax changes.

Knight Frank reports average prices in Prime Central London fell 2.2% in the year to May, the sharpest annual decline since August 2024. Sales activity has also dipped, with transactions in London’s prime markets down 7% over the past six months compared with the previous year. Lack of demand is being blamed on recent changes to the UK’s non-dom tax regime and the introduction of a higher Stamp Duty on additional properties.

However, the picture is more stable in Prime Outer London, where buyers are more likely to be domestic and driven by need rather than investment. Prices there rose 1.1% over the same 12-month period. The growing divergence between central and outer prime markets suggests changes to tax policy are having a more pronounced impact on discretionary, internationally focused buying behaviour.

Spending review – the impact on housing

Chancellor Rachel Reeves has announced a tenyear, £39bn investment in affordable and social housing across England as part of the 2025 Spending Review. The Chancellor called the investment “the biggest cash injection into social and affordable housing in 50 years.”

With plenty of scepticism about Labour’s ability to deliver on a manifesto promise to build 1.5 million homes in five years, new analysis from JLL suggests they could get closer than originally thought if they can squeeze 500,000 homes out of the cash injection.

Nick Whitten, EMEA Head of Living Research at JLL, said, “A £39bn pledge for new affordable housing over the next decade is the largest government commitment we’ve seen in half a century – and one that has to be commended at a time when the public purse is more than a little stretched. But while the ambition is clear, the reality is complex.”

Festival hotspots come with a housing premium

New Yopa research suggests living near major UK music festivals comes with property premium.

Analysis of 20 festival postcodes found average house prices of £382,072, 41% higher than the UK average. The steepest increase is found near Leeds Festival. Homes in the LS22 postcode average £466,244, a full 91% higher than the wider Leeds area. Creamfields isn’t far behind, with WA4 prices sitting 89% above the Halton average.

Other festival locations also carry notable uplifts. House prices in CA10, home to Kendal Calling, are 40% above the Westmorland and Furness average, while Liverpool’s L17 postcode, which hosted Radio 1’s Big Weekend, is 30% higher than the city average. Reading Festival bucks the trend, with RG1 house prices 20% below the wider local average. Still, Yopa’s findings suggest that, for many, living near a festival site means paying more for having music on your doorstep.

All details are correct at the time of writing (18 June 2025)

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.