An introduction to leaving an inheritance

| Inheritance Tax (IHT) affects more people due to rising asset values—early planning is essential to mitigate it | Gifting, trusts and charitable donations can reduce your IHT liability with the right advice and planning | Creating a Will ensures your estate is distributed as intended and avoids unnecessary tax complications |

Contents

Throughout life, many things can have a significant impact on your financial needs and plans for the future, including passing on your wealth. As your life journey progresses, you will need to adapt to an endless list of variables such as:

- Changes in personal relationships

- property purchase

- helping younger members of the family

- business commitments

- retirement

- inheritance planning

The financial planning process will help to support you by ensuring that your financial plans remain relevant and on track for the future. Our conversations with you are expertly focused on all aspects of your goals, alongside our knowledge to help you stay on the best financial path for you.

This guide focuses on Leaving an Inheritance, a complicated and sensitive area of financial planning.We can apply our expertise to advise you on ways to minimise the amount of tax your beneficiaries may have to pay, to keep things as simple and straightforward as possible.

Leaving an inheritance for your loved ones

Being able to leave a legacy to our loved ones, is an ambition many people aspire to. It’s an emotive topic which requires careful navigation and planning, but it’s a conversation worth starting sooner rather than later. A welcome inheritance can come with an unwelcome tax bill, which can often be avoided with careful planning.

Inheritance Tax (IHT) and you

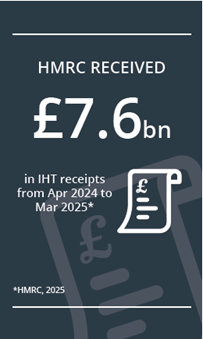

More people than ever before are calculating the value of their estates and finding they have a greater IHT liability. IHT can cost your estate thousands of pounds when you die, but with expert planning you can legitimately mitigate this tax, meaning you can pass on assets to your family as intended.

These days, you don’t have to be extremely wealthy to be affected by IHT. The beneficiaries of anyone who has an estate worth over £325,000 could end up paying 40% tax on anything over this amount.

The benefits of forward planning

Without advance planning, your estate (property, other assets and money), will not be distributed in the way you want when you die. Good financial planning means:

- You decide who inherits

- You decide who gets what

- You place constraints if necessary

Protecting your family’s financial future

You need to understand the basics before embarking on your IHT plan.

What is IHT?

IHT is a tax payable on money, savings, property and any other assets you pass on when you die, and potentially on some gifts you make during your lifetime. The amount payable is calculated after debts and funeral expenses have been deducted.

The beneficiaries of anyone who has an estate worth over £325,000 could end up paying 40% tax on anything over this amount.

Who pays IHT?

When someone dies, the administration of their estate will fall to their executors, or administrators if they die intestate (without a Will). If the estate is liable for IHT, it is usually payable at 40%. Your executor will be responsible for paying the tax, which can only come from the deceased person’s estate with the prior agreement of HM Revenue & Customs. Any IHT due from your estate should be paid within six months of death. Once the tax has been paid, the Grant of Probate can be made, allowing the assets or their proceeds to be distributed to beneficiaries.

There are several ways to minimise the amount of IHT your family pay when you’re gone, including:

- Maximising IHT allowances

- Gift exemptions

- Put money, property or investments into a trust

- Leave something to charity

- Take out a life insurance policy

- Business and agriculture reliefs

Maximising IHT allowances

We can ensure you maximise all the allowances available to you.

What is the current Inheritance Tax threshold?

The current IHT threshold is £325,000 for an individual and £650,000 for a married couple or civil partners, meaning if your estate is worth over £325,000 you could end up paying IHT on anything over this amount. This threshold will remain in place until 2030.

An unused nil-rate band can be passed to the surviving spouse or civil partner on death. If one partner has already died, the allowance could be £650,000, but will depend on how much of the allowance was used on that partner’s death.

The main residence nil-rate band

In response to the continuing rise in house prices, the government introduced an additional nil-rate band when a residence is passed on death to a direct descendant. This was introduced in April 2017.

This nil-rate band will apply if you want to pass your main residence to a direct descendant like a child or grandchild (including step, adopted or foster children). It’s important to note that as only direct descendants can benefit, not everyone will be able to rely on it for IHT planning purposes.

The current the main residence nil-rate band is £175,000 and will remain at this level until 2030.

When added to the existing threshold of £325,000 this could potentially give rise to an overall allowance of £500,000 for those who are single or divorced, or £1m for those who are married or in civil partnerships.

However, it’s important to be aware that larger estates will find that residence relief is tapered. It will reduce by £1 for every £2 of value for estates valued over £2m.

During your lifetime – gift exemptions

The seven-year rule

To reduce the amount of IHT payable, many families consider giving their assets away during their lifetime. These are called ‘potentially exempt transfers’. For these gifts not to be counted as part of your estate on your death, you must outlive the gift by seven years. If you die within seven years and the gifts are worth more than the nil-rate band, taper relief applies, so that if you die say within six years, the tax will be less than if you were to die a year after making the gift.

Gifts must be outright and you can no longer benefit from them. So, if you were to gift your home, but continue to reside there without paying a commercial rent, HMRC would consider this to be a ‘gift with reservation’ and include the value as part of your estate.

Making IHT-free gifts

Each financial year you can make gifts of up to £3,000 (in total, not per recipient) and if you don’t use this in one tax year, you can carry over any leftover allowance to the next year. If you do this, you have to use up all your allowance in that tax year; you can’t accumulate several years’ worth of allowance and use it up in a single gift.

Gifts of up to £250 per person per financial year to any number of people are exempt. Each parent of a bride or groom can give up to £5,000; grandparents or other relatives can give up to £2,500 and any well-wisher can give £1,000. Gifts to registered charities and political parties are also exempt from IHT. There is another simple way of passing money to the next generation which allows for gifts to be made from surplus income. Conditions apply and advice would be needed to ensure that the gifts are made in the right way.

Gifting from surplus income

If you have enough income to maintain your usual standard of living, you can make gifts from your surplus income, such as regularly paying into your child’s savings account. To make use of this exemption, it’s essential that you keep very good records of these gifts. The gift will only qualify for exemption if it is part of a regular pattern of giving, and if you can demonstrate that you maintained your normal standard of living after making the gifts and all other usual expenditure, if you don’t, IHT might be due on these gifts when you die.

The Financial Conduct Authority (FCA) does not regulate Will writing, tax and trust advice, and certain forms of estate planning.

Tips on leaving an inheritance

Make a gift every year

Maximise the use of your annual allowances; doing so can reduce the ultimate tax liability substantially.

Make a Will

If you do not clarify your wishes in a Will, the state will distribute your estate according to a formula set out in the rules of intestacy. The results are not always what you would expect and can create unnecessary tax liabilities.

Put things into trust

It’s worth considering putting some of your cash, investments or property into a trust. There is then the potential for this to no longer form part of your estate for IHT purposes.

Leave something to charity

You can reduce the rate at which IHT is payable by leaving at least 10% of your estate to charity. This would reduce the rate of tax payable on the balance of the estate from 40% to 36%.

Take out life insurance

Whilst this won’t reduce the amount of IHT that will be due on your estate, the payment from the policy could make it easier for your beneficiaries to pay the bill. You would need to have the policy written under trust to ensure that it doesn’t form part of your estate on your death. Payments of premiums are considered gifts for IHT unless they can be covered by one of the IHT exemptions.

Take professional advice

These days, more estates are likely to be subject to IHT, so taking expert advice could save your beneficiaries substantial amounts of tax. If you feel that your estate is likely to be subject to IHT, we can develop a robust financial strategy that meets your needs. We will listen to you and apply our financial acumen, always looking after your interests as we would our own, with absolute integrity. We provide advice designed to reflect your needs and support you in making vital financial decisions.

The Financial Conduct Authority (FCA) does not regulate Will writing, tax and trust advice, and certain forms of estate planning. Tax rates are based on current legislation and are subject to change.

We’re here to help

If you have queries or would like to discuss any aspect of IHT or estate planning, get in touch.

Tax rates are based on current legislation for the 2020/21 tax year, which is subject to change.

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for guidance only. Some rules may vary in different parts of the UK. We cannot assume legal liability for any errors or omissions it might contain. Levels and bases of, and reliefs from taxation are those currently applying or proposed and are subject to change; their value depends on the individual circumstances of the investor. No part of this document may be reproduced in any manner without prior permission.