Economic Review January 2026

| UK economic momentum strengthened into 2026, with GDP rebounding and business surveys signalling improving private sector confidence | Inflation ticked higher in December, but economists expect the rise to fade as temporary factors unwind | Markets delivered solid January gains despite volatility, while labour demand softened and consumer confidence edged higher |

UK growth rate stronger than expected

Official figures released last month by the Office for National Statistics (ONS) showed the UK economy bounced back strongly in November, while survey data points to a further rise in economic momentum at the start of this year.

According to the latest monthly gross domestic product (GDP) statistics, UK output rose by 0.3% in November, following a decline of 0.1% in October. This rebound, which beat economists’ expectations of a 0.1% rise, was driven by an increase in industrial output following Jaguar Land Rover’s return to full production after its cyberattack and stronger than anticipated growth from the services sector.

As monthly figures can be volatile, ONS prefers to focus on growth across a three-month rolling period and, on this measure, the latest GDP data showed the economy grew by 0.1% in the three months to November. This performance was significantly better than the 0.2% contraction economists had forecast in a Reuters poll, reflecting not only November’s upside surprise but also an upward revision to September’s growth rate.

The latest evidence from a closely-watched economic survey also provides signs of growing economic momentum, with the preliminary headline growth indicator from S&P Global’s UK Purchasing Managers’ Index (PMI) jumping from 51.4 in December to 53.9 in January. This represents the fastest overall rate of private sector expansion for just under two years.

Commenting on the survey’s findings, S&P Global Market Intelligence’s Chief Business Economist Chris Williamson said the data suggests UK businesses “kicked up a gear” in January, with firms demonstrating “encouraging resilience in the face of recent geopolitical tensions.” Mr Williamson also noted that January’s flash PMI data was indicative of “robust quarterly GDP growth approaching 0.4%” and that the survey puts optimism about the business outlook at its highest level since before the 2024 Autumn Budget.

Inflation rise likely to be temporary

Although recently published ONS data did show that the headline inflation rate rose for the first time in five months, economists do still typically expect price growth to slow sharply across the next few months.

The latest official inflation statistics revealed that the Consumer Prices Index (CPI) 12-month rate – which compares prices in the current month with the same period a year earlier – stood at 3.4% in December. This reading was up from 3.2% in November and slightly higher than the consensus view from a Reuters poll of economists.

ONS noted that tobacco and airfares were the biggest contributors to December’s rise. In both cases, though, the change in prices was largely driven by one-off factors like an increase in duty charged on tobacco products forcing the CPI rate higher.

Despite December’s rise, most economists expect inflation to slow sharply over the coming months. Indeed, Bank of England (BoE) Governor Andrew Bailey has previously stated his belief that the headline CPI rate is likely to be sitting close to the Bank’s 2% target by April or May this year.

Not all members of the BoE’s nine-strong interest-rate-setting Committee, however, agree with the Governor’s analysis. Megan Greene, for example, recently reiterated that she remains concerned about how much businesses might raise wages this year and the challenge that could pose to the Bank hitting its inflation target.

The outcome of the BoE’s next interest rate deliberations is due to be announced on 5 February. A recent Reuters poll found that an overwhelming majority of economists expect Bank Rate to be held steady at that meeting; a slim majority of respondents though did predict a further 25 basis point cut to be sanctioned at the Committee’s following meeting in March.

Markets

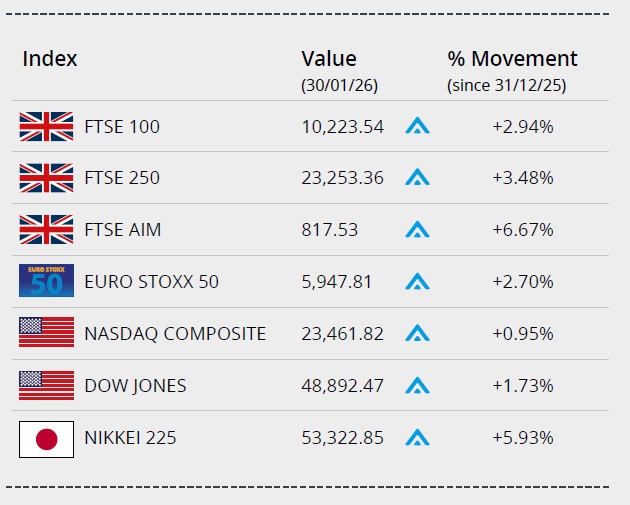

Global indices closed the month in positive territory, despite some volatility at month end.

On 30 January, President Trump nominated former Federal Governor Kevin Warsh to succeed Jerome Powell as Chairman. The news prompted the price of metals to trade sharply lower as investors repriced their outlook for monetary policy. US equities, which reached highs earlier in the week, also pulled back on the news.

The Federal Reserve voted to retain rates in the last week of the month. Expectations are for further cuts as the year progresses. The Dow Jones closed up around 1.73% on 48,892.47. The NASDAQ registered a modest monthly gain of 0.95% to close on 23,461.82.

In the UK during January, the FTSE 100 passed the 10,000 mark for the first time and closed the month almost 3% up – on 10,223.54. Meanwhile, the FTSE 250 ended January 3.48% higher on 23,253.36 and the FTSE AIM registered over 6.6% to close the month on 817.53.

Data published at month end showed economic growth at the end of 2025 in the eurozone had surpassed expectations and unemployment fell. The Euro Stoxx 50 closed January 2.7% higher on 5,947.81. In Japan, the Nikkei 225 ended January on 53,322.85, gaining over 5.9% in the month.

On the foreign exchanges, the euro closed the month at €1.15 against sterling. The US dollar closed at $1.37 against sterling and at $1.18 against the euro.

Brent Crude closed January at around $65 a barrel, recording a monthly gain of over 7%. Concerns around heightened geopolitical tensions have provided support, although the price retreated at month end. Gold closed the month trading around $4,936 a troy ounce, a gain of over 13% in January. The price slid at month end as the news of Warsh’s nomination weighed on the precious metal and the stronger dollar impacted.

Jobs market remains subdued

The most recent set of labour market data has provided more evidence of a softening in the UK jobs market, with the number of employees on firms’ payrolls falling and pay growth edging lower.

Statistics released last month by ONS showed demand for workers continues to wane, with provisional tax data for December revealing a 43,000 monthly fall in the number of people in payrolled employment; this follows a 33,000 drop in November. ONS noted that this decline was concentrated in retail and hospitality reflecting “’weak hiring activity’ in these sectors.

The data release also revealed a further slowdown in wage growth with average weekly earnings, excluding bonuses, rising at an annual rate of 4.5% in the three months to November, a slight dip from 4.6% in the previous three-month period. This easing was entirely due to a sharp slowdown in private sector pay increases, which dropped to their lowest level in five years.

Survey evidence also points to more recent weakness. Data from Adzuna’s latest survey, for instance, showed that ‘competition for roles intensified and hiring slowed’ across many sectors in December, while UK PMI data suggests ‘the pace of job losses accelerated’ across the private sector in January.

Surprise rise in retail sales

Last month’s official retail sales statistics revealed an unexpected rise in sales volumes, while survey evidence shows consumer confidence edged up to its highest level since August 2024.

The latest ONS data showed total retail sales volumes grew by 0.4% in December, surprising economists who had predicted a slight fall. This rise represents the first monthly increase since September and marked a brighter end to an otherwise disappointing final quarter, with volumes falling by 0.3% across the last three months of 2025 compared to the previous quarter.

ONS said internet retailing performed well in December, with online jewellers enjoying a particularly strong month boosted by high demand for gold and silver, while there was also a small rise for supermarkets and sales of automotive fuel. Non-food stores, such as department, clothing and household stores, fared less well though, with sales across this sector down 0.9%.

Encouragingly for retailers, last month’s GfK survey did report further improvement in consumer morale, with its headline sentiment index rising one point to -16. January’s data did, however, mark ten years since consumer confidence was last in positive territory, and GfK Director Neil Bellamy admitted, “we remain a long way from consumers feeling that better days are around the corner.”

All details are correct at the time of writing (02 February 2026)

The value of investments can go down as well as up and you may not get back the full amount you invested. The past is not a guide to future performance and past performance may not necessarily be repeated.

It is important to take professional advice before making any decision relating to your personal finances. Information within this document is based on our current understanding and can be subject to change without notice and the accuracy and completeness of the information cannot be guaranteed. It does not provide individual tailored investment advice and is for information only. We cannot assume legal liability for any errors or omissions it might contain. No part of this document may be reproduced in any manner without prior permission.